The risk premiums that have to be paid by a number of EMU countries on the capital market remain stubbornly high. This is testimony to the market's lack of confidence in these countries' ability to get to grips with their debt problems without the need for debt restructuring. It is not, however, just the financial markets, but also policymakers that seem increasingly convinced that Greece, at least, will have to restructure its debt.

Eurozone sovereign debt manageable

Download

Is there a tipping point which can be used to determine when sovereign debt restructuring is advisable or even imperative? "Greece's government debt ratio came in at 140 percent of GDP last year – but Japan's was almost 200 percent. As the Japanese example shows, high debt levels do not necessarily translate into a considerable interest burden," said Michael Heise, chief economist at Allianz SE. "Greek interest payments in 2010 totaled around 6 percent of GDP – back in 1995, they were still hovering at around 11 percent of GDP. These examples show that pinpointing generally valid criteria for debt restructuring is far from straightforward."

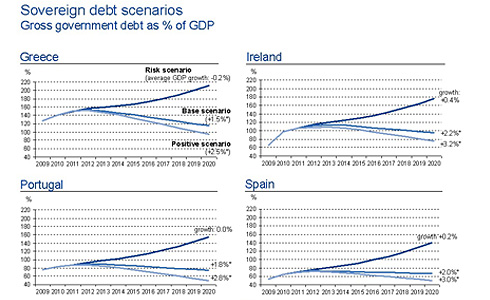

The economists at Allianz have put the spotlight on the debt and interest burdens of Greece, Ireland, Portugal and Spain, using various scenarios. The development of both these parameters hinges crucially on fiscal policy discipline, future economic growth and the financing conditions prevailing on the financial markets.

The base scenario assumes a resolute commitment to fiscal consolidation in all four countries, coupled with moderate growth prospects (average growth rates for 2011-2020: Greece 1.5 percent, Ireland 2.2 percent, Portugal 1.8 percent, Spain 2.0 percent).

Sovereign debt scenarios: Gross governement debt as % of GDP

Following the consolidation successes seen last year in Greece (primary deficit of 10 percent of GDP in 2009 cut to 3.5 percent of GDP in 2010), in Portugal (primary deficit cut from 6.5 percent to 4.5 percent) and Spain (primary deficit cut from 9 percent to 7 percent), these countries should also be able to push their new borrowing down to below the 3 percent mark in 2013/14, in line with the consolidation plan. Ireland is not expected to be able to hit this target until 2015.

The base scenario also assumes that fiscal policy discipline will remain in place until 2020. This means that government spending will not increase at a faster rate than nominal economic growth. Debt as a percentage of GDP will peak in all four countries in 2012/2013 before declining on an increasingly downward slope up to 2020. Greece's debt level will fall from 150 percent (2011) to 115 percent (2020). Due to the longer duration of government liabilities and the use of the rescue fund, the overall increase in the interest burden will be moderate. The implicit interest rate on Greek debt (interest payments/overall debt) will rise from presently 4.5 to 5.0 percent by 2020.

"Despite the prevailing risks, the scenarios show that reversing the debt momentum in the crisis-ridden EMU countries is not an insurmountable task. Prolonged periods of strict government consolidation policy, coupled with structural reforms, do not translate into weak economic growth in the long run. Rather, regained confidence among the corporate sector and private households bolsters growth potential in the medium term," said Heise.

It remains up to the policymakers to prevent debt restructuring. Attempts to railroad individual countries into urgent debt restructuring are not productive. On the other hand, a "painless" debt restructuring for Greece, in the form of a buy-back of government bonds on the secondary market, would not cause contagion and provide the country with a little relief. Although consolidating the Greek budget without debt restructuring is a huge challenge, success would not only provide a long-term boost to the country's economic policy reputation but also help promote the stability of the euro. The same applies to the other countries that have overloaded sovereign debt.

The financial crisis has brutally exposed the limitations of economic governance in both the EU and the EMU. Europe needs institutional reforms geared to averting major macroeconomic balances in future. Heise: "Europe's priorities must be the prompt introduction of the new Stability and Growth Pact, equipped with a sanction mechanism with real teeth. Under the current proposals the role of the Council in the deficit proceedings is still too dominant. The proposed early warning system for macroeconomic imbalances also needs to be fleshed out swiftly. Binding indicators and the triggers for swift and automatic sanctions have yet to be established. There must also be early clarification of the shape and form of the European Stability Mechanism from 2013, with clearly defined default criteria to provide reliable guidance to the markets."

You can download the Working Paper "Scenarios for government debt in Europe" at www.allianz.com/economic-research/en/ under Working Papers.

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer.

Link to the disclaimer