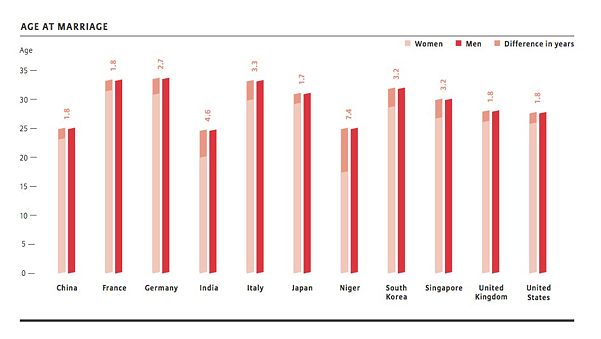

Ahead of the International Widows’ Day (June 23rd), Allianz has released a study describing the financial bind many women face when getting married. According to the report, “The Younger Wife’s Curse,” women are on average younger than their husbands and outlive them. In the past, these extra years were more of a curse than a blessing as many women spent them in old-age poverty. “Social norms are changing, and pensions are improving for women, so today’s younger women appear better positioned to ensure their own financial security. This is a trend that the financial industry will need to respond to in the coming years”, says Brigitte Miksa, Head of International Pensions at Allianz.

According to figures reproduced in “The Younger Wife’s Curse”, older women are at greater risk of poverty in 27 out of 30 OECD countries. Poverty rates are 15% for women and 11% for men. Researchers investigating poverty have shown widowhood is the single most predictive factor concerning a decrease in female income in later years. This is often due to the shorter working lifetime of previous generations of women and dependency on their spouse’s Social Security and private pension benefits, which tend to decrease after his death. In addition, the couple’s assets are often depleted by costs linked to the sickness and death of the spouse making thenewly widowed woman financially poor even if as a married couple they were not.