One of the major challenges for private investors preparing for retirement is coping with volatile financial markets. Whereas younger investors still have time to adapt and compensate for investment decisions which might not prove favorable or which were influenced by negative market movements, people close to retirement do not have that luxury.

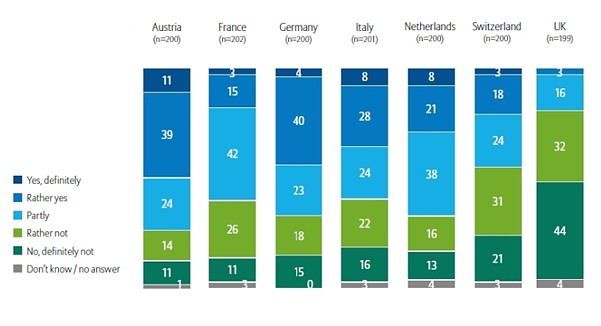

Allianz International Pensions conducted a new survey in seven European countries among 1,400 wealthier people between ages 50 and 70. One of the key findings is that although there is a great deal of uncertainty around financial markets and how to invest in the current environment, people in Austria, Germany and Italy largely trust the euro. More scepticism is found in France and in the Netherlands, while the greatest euro scepticism is found in the UK.

“In the current situation, investors are well advised to take greater responsibility for adequate investment planning and should ’Rethink Retirement’ – particularly those people close to retirement age,” says Jay Ralph, Chairman of Allianz Asset Management and a member of the Board of Management of Allianz SE.