The current financial crisis and the associated low capital market interest rates are proving a real test of strength for life and pension insurance. But low interest rates are not the only challenge facing the product, which is celebrating its 250th birthday this year. New supervisory law regulations such as Solvency II and the introduction of unisex rates are also making life difficult for the product at the moment. Nevertheless, when it comes to setting funds aside for old age, protecting oneself against occupational incapacity and invalidity, as well as other risks that are directly associated with life in general, there is virtually no better alternative.

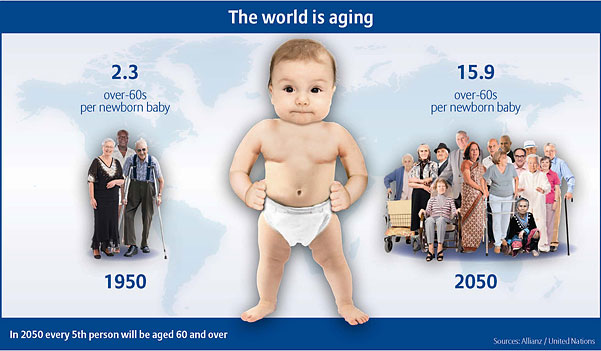

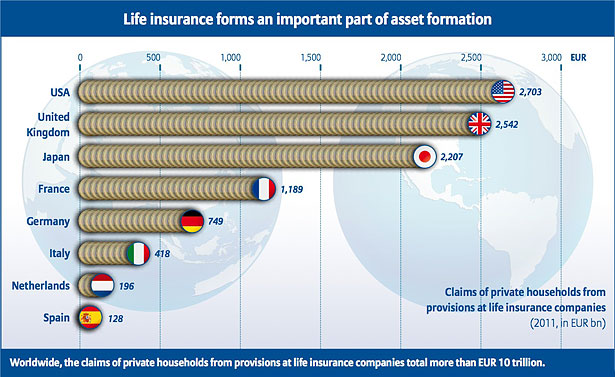

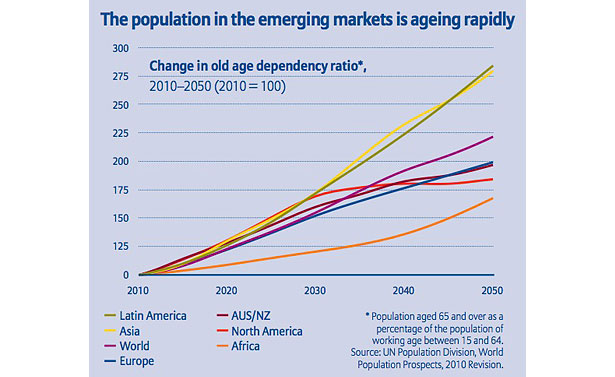

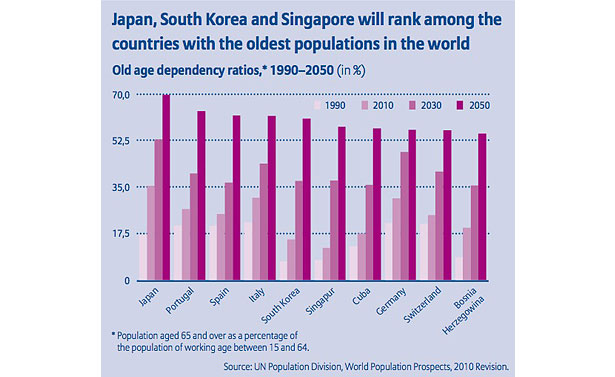

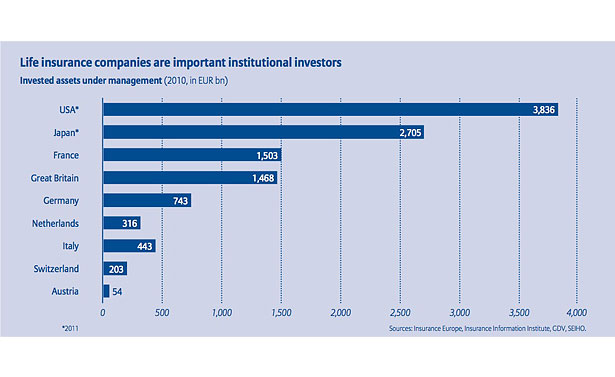

In fact, demographic trends mean that the product is becoming more and more important to individuals: "As societies become older and older due to rising life expectancy levels on the one hand and lower birth rates on the other, the demand for funded company and private provision will continue to rise in the future", says Prof. Michael Heise, Allianz Chief Economist and Head of Corporate Development in the new issue of the Allianz Demographic Pulse, which takes a critical look at the issue of life insurance. "Life insurance companies are key players on the global capital market and, with their long-term investment policies, help to stabilize the capital markets. What is more, these companies' conservative investment policies spared many customers hefty losses during the crisis. Despite all of the criticism leveled against it, life insurance is important, secure and profitable for individuals", summarizes Heise.