“There’ll be babies,” they said, “Nurseries everywhere full of new babies, thanks to the coronavirus pandemic and lockdown.”

On the surface at least, it made sense. People in high-income countries were home together longer, without the distractions of bars and restaurants, travel, shopping, movie theaters, or even the office. How could they help but have more children?

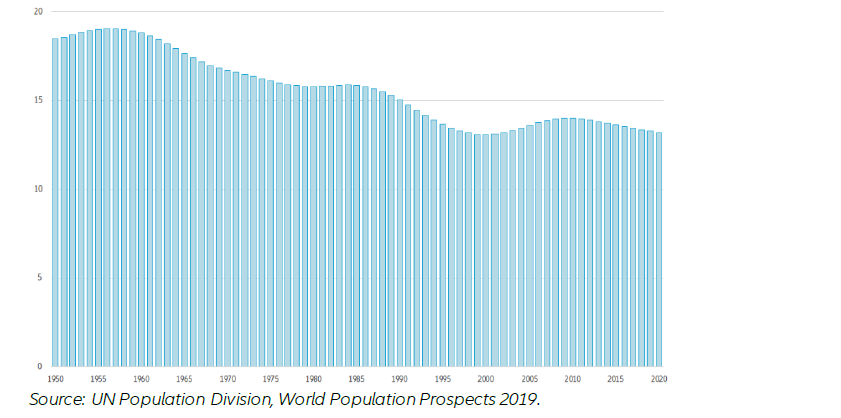

But as expectations of the Covid baby boom faded, so too did hopes of a reprieve, however temporary, from the long trend of plummeting birth rates in industrialized countries - and the global story of ageing populations.

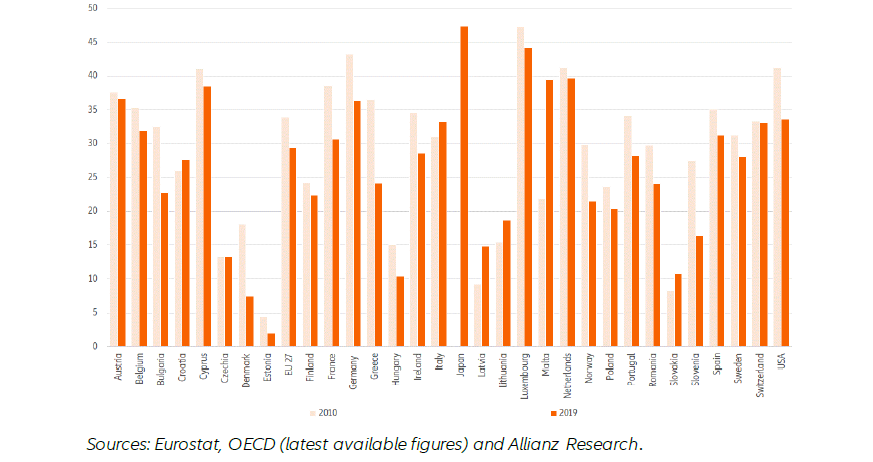

On a societal level, this is hardly the news we want to hear. However, on an individual level, postponing motherhood could give women a chance to focus on their education and career before starting a family, in turn, narrowing the pension gap between men and women, according to a report by Allianz Research.