Covid-19 exposed the protection gaps in our lives and livelihoods. As such, the pandemic taught us harsh lessons on the importance of securing our future. Or did it?

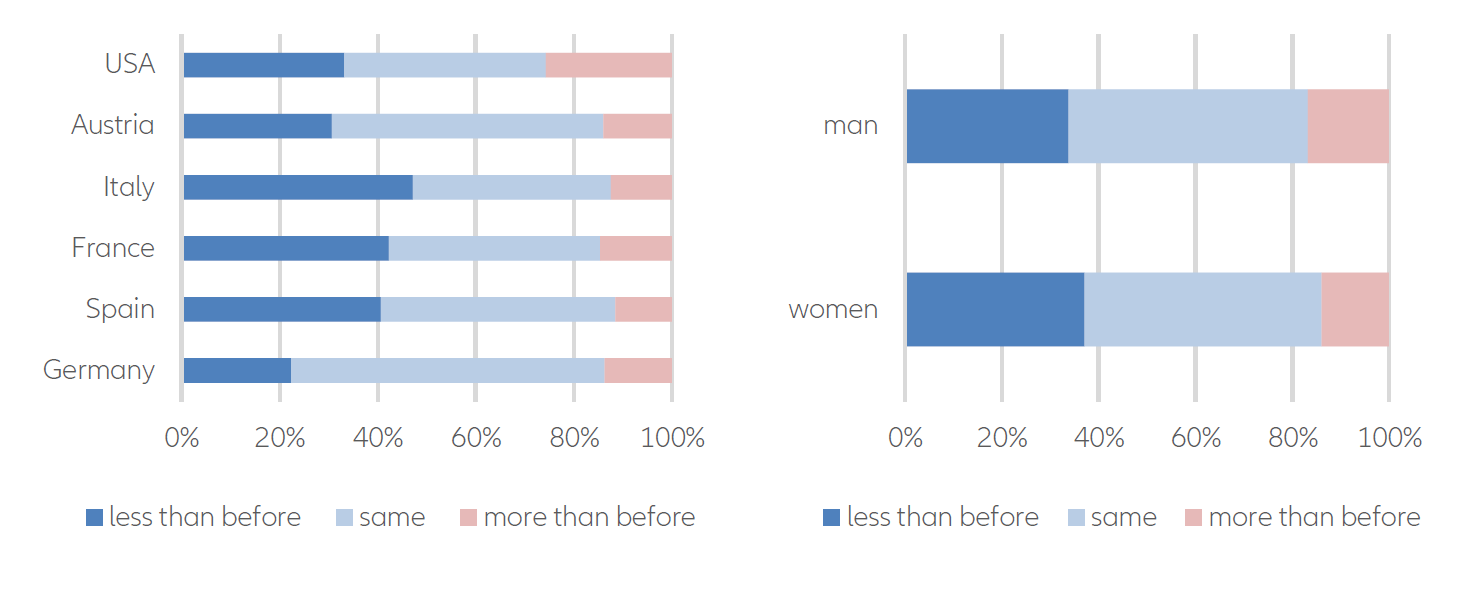

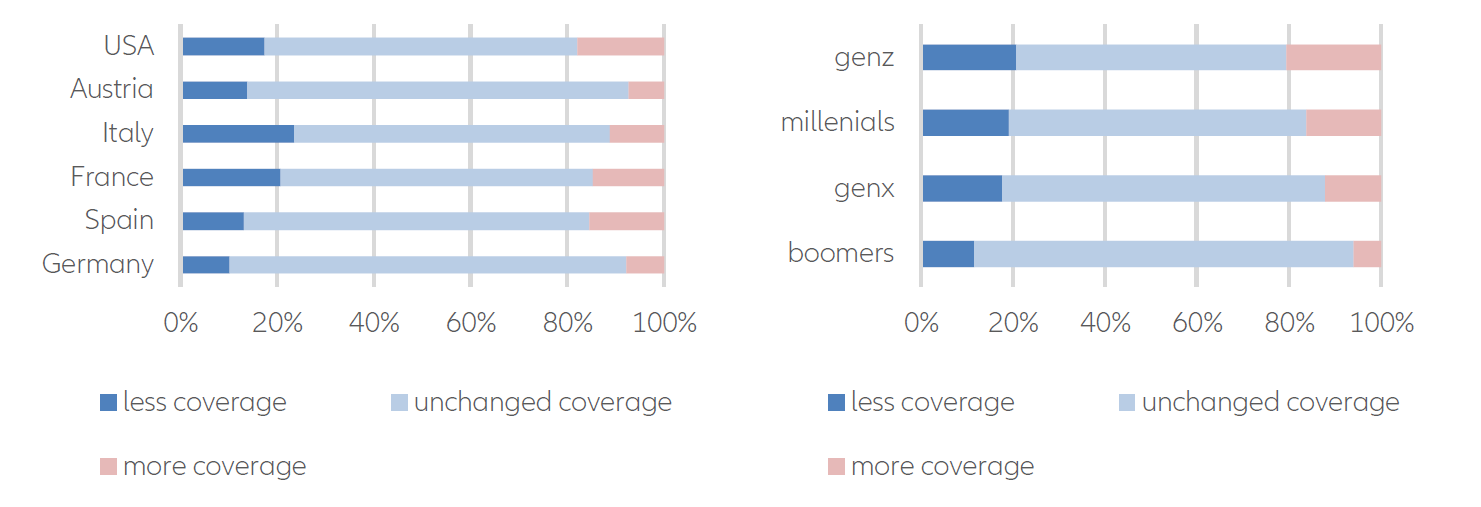

Even after the Covid-19 carnage, most respondents of the survey had surprisingly low interest in increasing their insurance coverage for potential adversities. While respondents from the countries that experienced the worst of the virus showed a greater interest in raising their coverage, a significant number of people from a couple of badly-hit countries were actually planning to lower their insurance spend. The U.S. led the ‘increase’ brigade with 18 percent, while worst-affected European countries – Spain, France and Italy – followed with 16 percent, 15 percent and 11 percent, respectively.

The Austrians and the Germans, with 7 percent and 8 percent were the least interested in increasing coverage. Is it because they are already more insured than other Europeans? Or does it have to do with the relatively lower impact of Covid-19 on these countries?

In Italy and France, two countries of the worst-affected European countries, more than a fifth of the respondents said they would like to cut their spend on insurance.

“Covid-19 revealed the fragility of our modern, hyper-connected lives and disclosed glaring protection gaps. In this context, risk awareness and demand for risk cover would be expected to rise. However, our survey pours some cold water on such hopes: Most respondents would like to keep the same insurance coverage and investments that they had before. Nostalgia for our pre-pandemic existence should not stop us from taking this as a learning opportunity and try to remedy some of the errors of the past,” says Allianz economist Patricia Pelayo Romero, one of the authors of the study.