The Covid-19 crisis will trigger a major acceleration in business insolvencies due to both the suddenness and historic size of the economic shock and its expected lasting effects, according to a new study by Euler Hermes, the world’s largest trade credit insurer. These lasting effects are critical for companies that were already the most fragile before the crisis and are now among the sectors hit the hardest by measures to contain the pandemic (transportation, automotive, non-essential retail, hotels and restaurants).

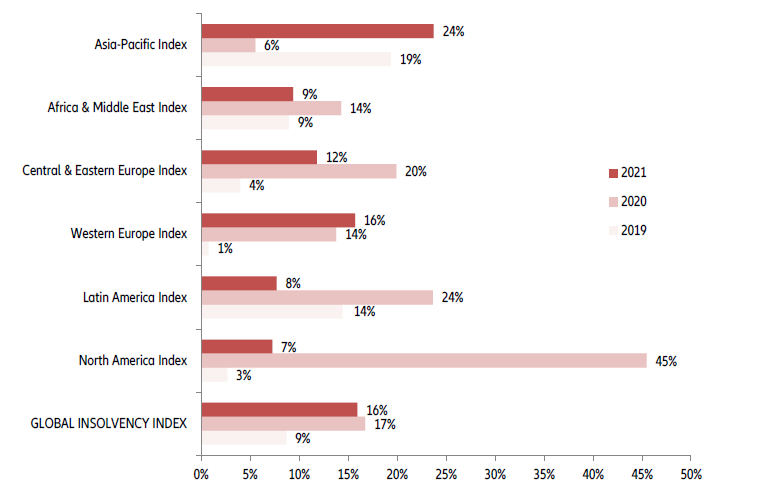

At a global level, Euler Hermes’ insolvency index is expected to surge to a record high of +35 percent cumulated over a two-year period (after +17 percent in 2020 and +16 percent in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis. This would represent a +16 percent year-on-year CAGR over the two-year period, similar to the intensity recorded on average amid the 2008 financial crisis.