As with anything new, an EV bring its own challenges. One of the biggest risks can lie at its very heart – the battery.

Battery life and performance are critical issues for EVs. It’s an expensive component to repair or replace, making product liability insurance an important topic for manufacturers and suppliers.

Although there is little evidence that EVs are more vulnerable to damages than conventional cars in an accident, damage to the battery could mean a much higher bill. “If the battery in an electric car has to be replaced, it can result in a total loss in many cases,” says Carsten Reinkemeyer, Head of Vehicle Technology and Safety Research at the Allianz Center for Technology (AZT) Automotive. “In addition, the fact that they can only go to specialist repair shops can contribute to costs.”

Fire poses another danger – if the electrical components and short circuits are defective, or if lithium-ion batteries combust when damaged, overcharged or exposed to excessive heat. Besides being hard to contain, high voltage battery fires could release copious amounts of toxic gases.

“Our analysis of reported claims from electric vehicles does not confirm that the technology is unsafe. However, an accident-related fire is reported much more frequently for EVs than for conventional cars, as this is more newsworthy,” says Reinkemeyer.

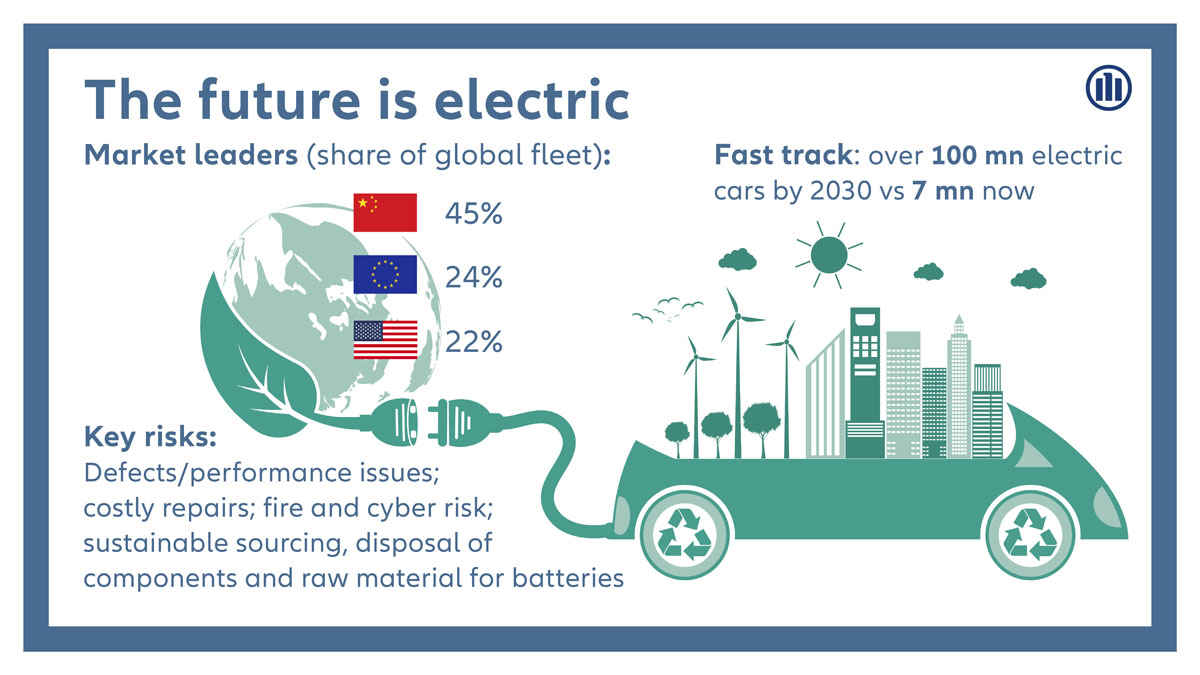

Although greener, EVs also pose potential liability and reputational risk for companies in relation to the environment. Tying up sustainable sources of critical components and raw material, as well as recycling and reusing material, are important topics for carmakers as production ramps up. Old and defective batteries also need proper disposal to avoid a pollution hazard.

Speed may be an attractive quality for a car but when it comes to the process of making cars, it can lead to missteps. Under pressure to accelerate the transition to e-mobility, manufacturers face potential product recalls if the combination of new technology, short development cycles and 3D/4D printing in production causes quality gaps.

Then there’s the universal threat – cyber risk. Electric cars are likely to rely on data, sensors and software including Artificial Intelligence, just like their conventional counterparts. This leaves them vulnerable to cyber issues, ranging from malicious attacks and system outages to bugs and glitches.

“In addition, EVs will consist of fewer but more integrated parts and components. What may have been three parts in a conventional car previously could be one part in an electric car today. However, the lower number of parts is increasingly connected through sensors and embedded software, adding a new layer of complexity and raising questions around how these parts interact and which producer or supplier is liable for a potential defect or faulty control,” says Daphne Ricken, Senior Underwriter Liability at AGCS.

“The increased complexity of the automotive supply chain and the reliance on software and technology producers will lead to new exposures and split liabilities in the value chain.”

For companies, another risk is of injuries to workers. Toxic fumes and fire risks during 3D printing or the handling of lithium batteries could lead to injuries, exposing companies and their insurers to claims.