Allianz Risk Barometer 2020

Cyber top peril for companies globally for the first time

Downloads

Changes in legislation and regulation (#3 with 27 percent) and Climate change (#7 with 17 percent) are the biggest climbers globally underlining the U.S.-China trade war, Brexit and global warming as increasing concerns for companies and nations. The annual survey on global business risks from Allianz Global Corporate & Specialty (AGCS) incorporates the views of a record 2,718 experts in over 100 countries including CEOs, risk managers, brokers and insurance experts.

"The Allianz Risk Barometer 2020 highlights that cyber risk and climate change are two significant challenges that companies need to watch closely in the new decade,” says Joachim Müller, CEO of AGCS. “Of course, there are many other damage and disruption scenarios to contend with, but if corporate boards and risk managers fail to address cyber and climate change risks this will likely have a critical impact on their companies’ operational performance, financial results and reputation with key stakeholders. Preparing and planning for cyber and climate change risks is both a matter of competitive advantage and business resilience in the era of digitalization and global warming."

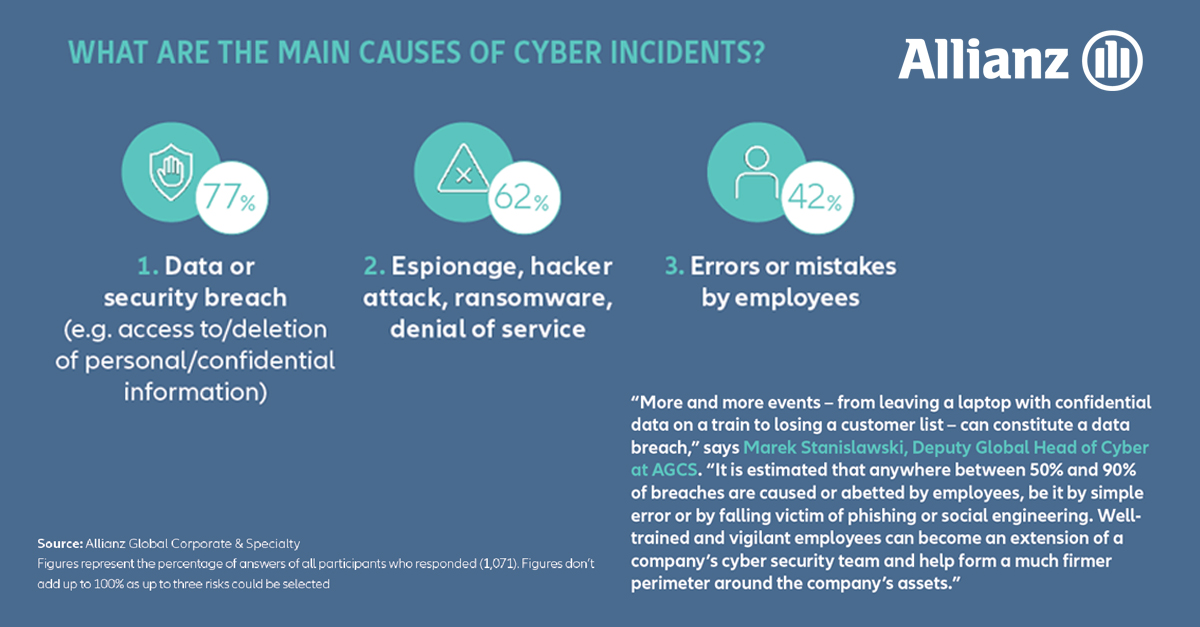

Cyber risks continue to evolve

In addition to being the top risk globally, Cyber incidents is among the top three risks in many of the countries surveyed; in Austria, Belgium, France, India, South Africa, South Korea, Spain, Sweden, Switzerland, the UK and the U.S. it also ranks as the top business risk. Businesses face the challenge of larger and more expensive data breaches, an increase in ransomware and spoofing incidents, as well as the prospect of privacy-driven fines or litigation after an event. A mega data breach ─ involving more than one million compromised records ─ now costs on average $42 million1 , up 8 percent year-on-year. “Incidents are becoming more damaging, increasingly targeting large companies with sophisticated attacks and hefty extortion demands. Five years ago, a typical ransomware demand would have been in the tens of thousands of dollars. Now they can be in the millions,” says Marek Stanislawski, Deputy Global Head of Cyber, AGCS.

Extortion demands are just one part of the picture: Companies can suffer major BI losses due to the unavailability of critical data, systems or technology, either through a technical glitch or cyber-attack. “Many incidents are the results of human error and can be mitigated by staff awareness trainings which are not yet a routine practice across companies,” says Stanislawski.

Business interruption – an undiminished threat with new causes

After seven years at the top, Business Interruption drops to the second position in the Allianz Risk Barometer. However, the trend for larger and more complex BI losses continues unabated. Causes are becoming ever more diverse, ranging from fire, explosion or natural catastrophes to digital supply chains or even political violence. “Digital supply chains and platforms today allow for full transparency and traceability of goods but a fire at a data center, a technical glitch or a hack could bring large BI losses for multiple companies that all rely and share the same system and which cannot switch back to manual processes,” says Raymond Hogendoorn, Global Head of Property and Engineering Claims at AGCS.

Businesses are also increasingly exposed to the direct or indirect impact of riots, civil unrest or terrorism attacks. The past year has seen civil unrest escalate in Hong Kong, Chile, Bolivia, Colombia and France, resulting in property damage, BI and general loss of income for both local and multinational companies as shops closed for months, customers and tourists stayed away or employees couldn’t access their workplace due to safety concerns.

Changes in legislation and regulation ranks third in the Allianz Risk Barometer, up from fourth in 2019. Tariffs, sanctions, Brexit and protectionism were cited as key concerns. Around 1,300 new trade barriers were implemented in 2019 alone. The U.S.-China trade dispute has brought the U.S. average tariff close to levels last seen in the 1970s. "Trade policy is becoming just another political tool for many different policy ends, such as economic diplomacy, geopolitical influence or environmental policy," explains Ludovic Subran, Chief Economist of Allianz. "This activism is not restricted to the U.S.: it has spread to Japan and South Korea, India and the EU."

New regulatory challenges in the next decade will focus on environmental impact, de-carbonization and climate change. "EU sustainability regulation is nothing less than a game changer. The impact on corporates will be as wide-ranging as that of the new rules on accounting and data protection were in the past," says Subran.

Climate change brings added risk complexity

Climate change rises to its highest-ever position of seventh in the Allianz Risk Barometer and is already in the top three business risks for the Asia-Pacific region overall, driven by risk management experts in countries and territories such as Australia, Hong Kong, India and Indonesia. An increase in physical losses is the exposure businesses fear most (49 percent of responses) as rising seas, drier droughts, fiercer storms and massive flooding pose threats to factories and other corporate assets, as well as transport and energy links that tie supply chains together. Further, businesses are concerned about operational impacts (37 percent), such as relocation of facilities, and potential market and regulatory impacts (35 percent and 33 percent). Companies may have to prepare for more litigation in future – climate change cases targeting ‘carbon majors’ have already been brought in 30 countries around the world, with most cases filed in the U.S..

"There is a growing awareness among companies that the negative effects of global warming above two degrees Celsius will have a dramatic impact," says Chris Bonnet, Head of ESG Business Services at AGCS. "Failure to take action will trigger regulatory action and influence decisions from customers, shareholders and business partners. Ignoring climate risk is more costly than grappling with it. Therefore, every company has to define its role, stance and pace for its climate change transition – and risk managers need to play a key role in this process alongside other functions."

About Allianz Commercial

Allianz Commercial is the center of expertise and global line of Allianz Group for insuring mid-sized businesses, large enterprises and specialist risks. Among our customers are the world’s largest consumer brands, financial institutions and industry players, the global aviation and shipping industry as well as family-owned and medium enterprises which are the backbone of the economy. We also cover unique risks such as offshore wind parks, infrastructure projects or Hollywood film productions. Powered by the employees, financial strength, and network of the world’s #1 insurance brand, we work together to help our customers prepare for what’s ahead: They trust on us for providing a wide range of traditional and alternative risk transfer solutions, outstanding risk consulting and Multinational services as well as seamless claims handling. Allianz Commercial brings together the large corporate insurance business of Allianz Global Corporate & Specialty (AGCS) and the commercial insurance business of national Allianz Property & Casualty entities serving mid-sized companies. We are present in over 200 countries and territories either though our own teams or the Allianz Group network and partners. In 2022, the integrated business of Allianz Commercial generated more than €19 billion gross premium globally.

These assessments are, as always, subject to the disclaimer provided below.

About Allianz

** As of December 31, 2023.

Press contacts

Allianz SE

Allianz Global Corporate & Specialty (Munich)

Allianz Commercial (Johannesburg)

Allianz Commercial (New York)

Allianz Commercial (Paris)

Allianz Commercial (Sao Paolo)

Allianz Commercial (Singapore)

Allianz Commercial (London)