Few would look back on this year fondly.

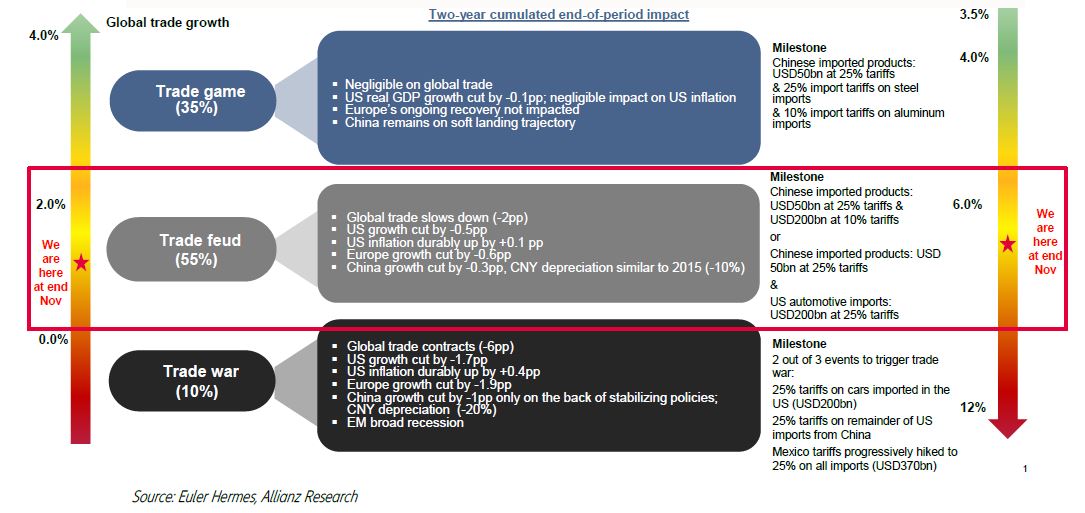

Social unrest cropped up in various parts of the world, markets danced up and down uncomfortably to the beats of U.S.-China show of trade aggression, and political uncertainties kept everyone guessing about the state of world affairs.

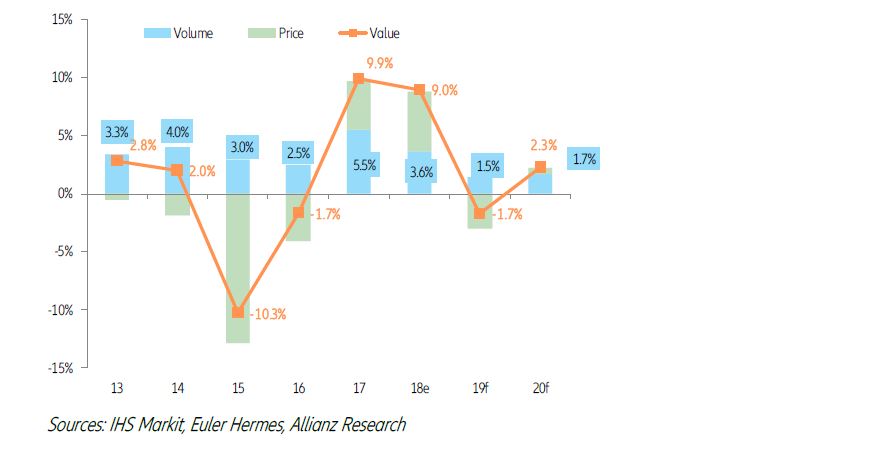

For global trade of goods and services, it might have been the worst year in a decade. At an estimated 1.5 percent, trade growth is forecast at the slowest in 10 years, according to the latest report by Allianz Research. The picture is uglier in value terms. World trade is expected to have contracted by 1.7 percent in 2019 – in simple words, exporters could have lost $420 billion worldwide!

Will the going get better? Nothing to celebrate yet, but the worst does seem to be behind us, believe Allianz economists.

For the moment, anyway.