Prudence came in adversity.

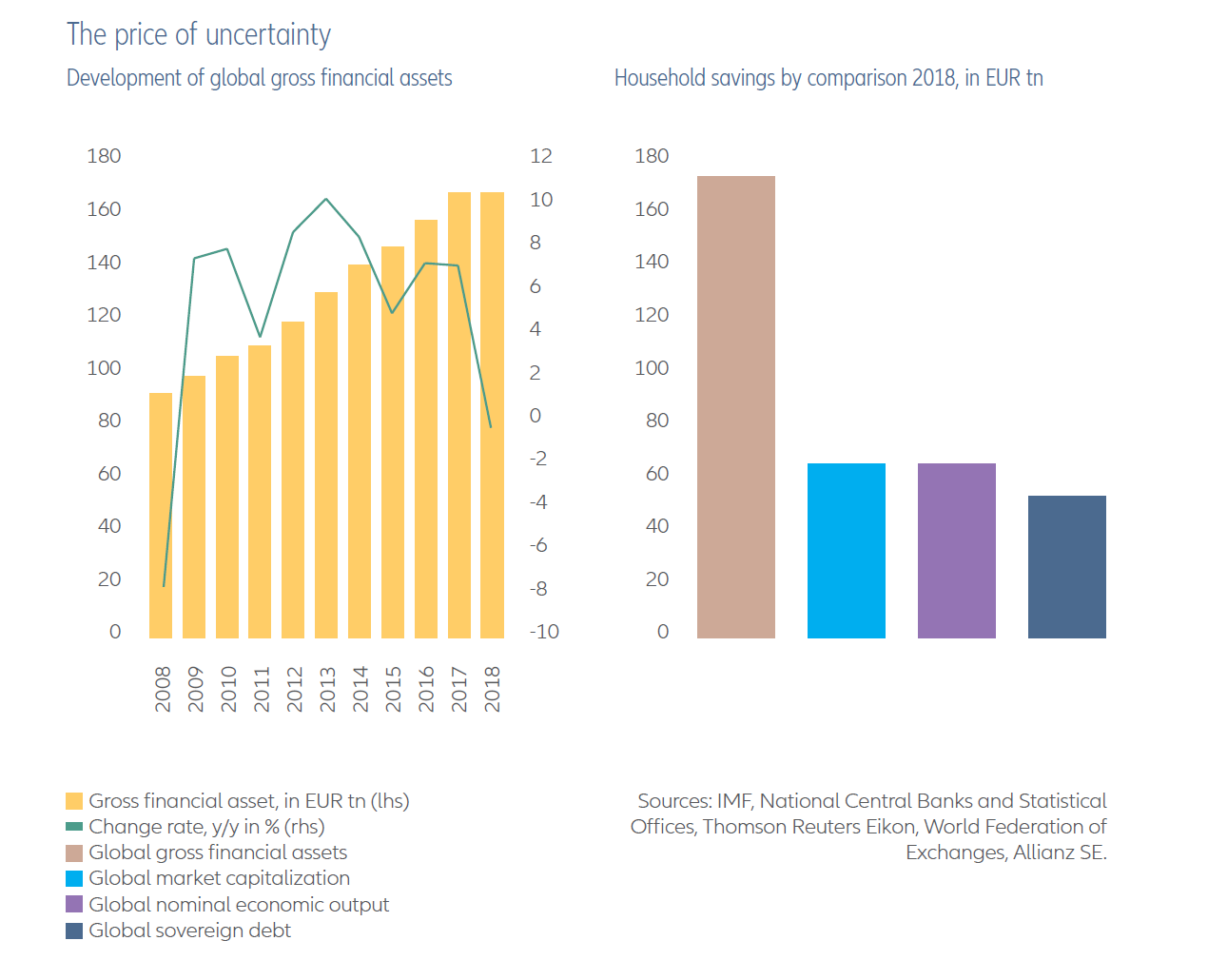

The lack of clarity drove households to tighten their purses, boosting fresh savings worldwide by a whopping 22 percent to a record high of over 2.7 trillion euros.

If the stock markets had behaved, this would have increased overall wealth by 2 percent. Unfortunately, equities struggled to ignore the U.S.-China love-hate relationship and the Brexit drama, tanking around 12 percent in 2018. For households, the fall in the price of assets, mainly equities, eroded value by a huge 3 trillion euros.

Surprisingly, the leaders of the frugality brigade were the Americans – a population known for its rather generous approach to money.

Fresh savings by the Americans jumped 46 percent to 1.8 trillion euros, accounting for two-thirds of savings in the industrialized world last year. Whatever extra the U.S. tax reform brought their way, the Americans swept into investments.

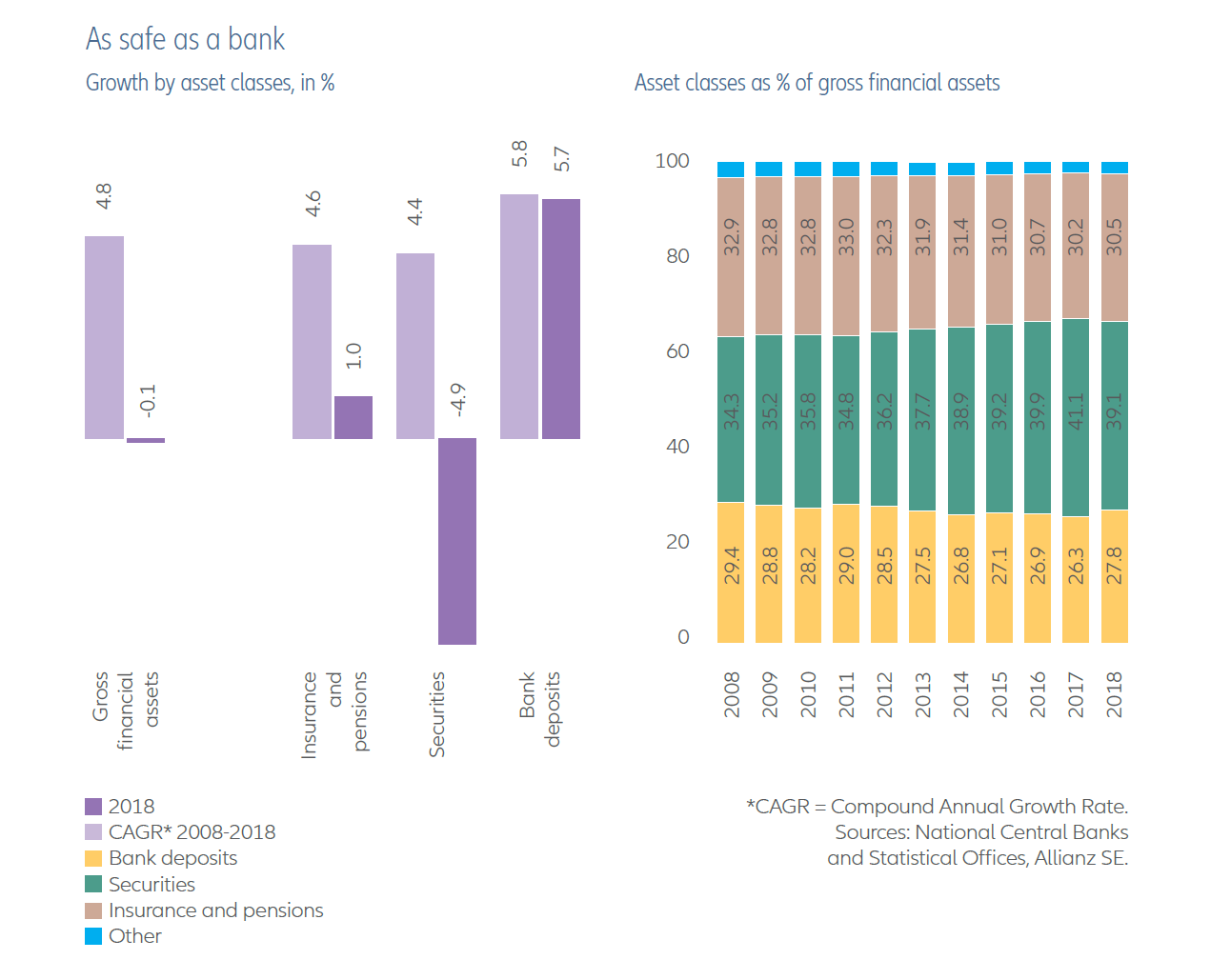

However, long-term savings seem to have been put on the backburner. Insurance and pensions accounted for just a quarter of the total fresh savings in 2018, compared with nearly half before and immediately after the crisis.

While the Americans invested, the rest of the world continued to play safe, parking its money mostly in bank deposits for the eighth straight year.

“It is a paradox savings behavior,” says Allianz economist Michaela Grimm. “Many people save more because they expect a longer and more active life in retirement. At the same time, they shun exactly those products that offer effective old-age protection, namely life insurances and annuities. The world needs nothing more than long-term savers and investors to deal with all the upcoming challenges.”