It’s a popular narrative, romanticized by novels and movies. The rich get richer, the poor get poorer. And then Robin Hood gets to step in.

In modern-day politics, the narrative plays out as the urban-rural income divide, used to explain a range of developments from Brexit to the Yellow Vest movement. Common perception is that technological changes and globalization are benefiting only the urban elites, leaving behind the village folk.

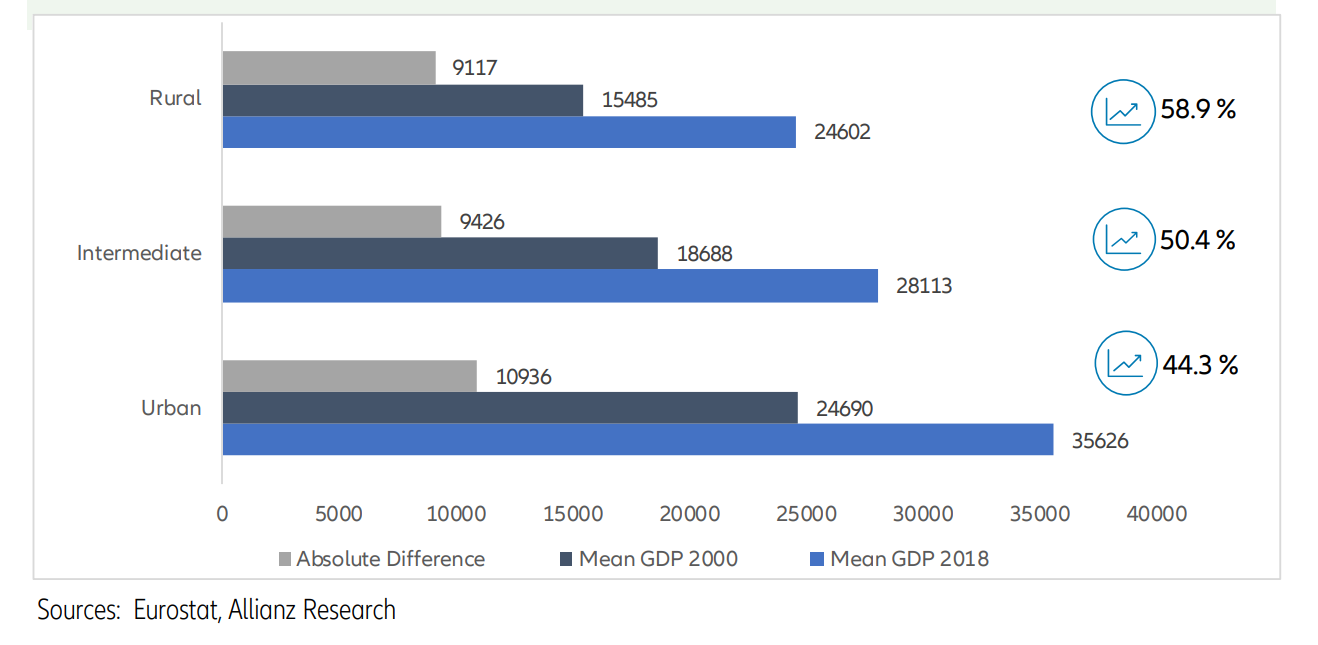

But do the numbers back up the perceptions? Or are facts again falling victim to common beliefs?

In its latest note, Allianz Research does a reality check...