A decade after the onset of the great financial crisis, the Eurozone as a whole appears to be in relatively good shape again. Unemployment has dropped sharply, the current account now boasts a robust surplus and the positive trend in public finances meant that in 2018, for the first time ever, all Eurozone countries respected the 3 percent Maastricht criterion with the average Eurozone budget deficit coming in at 0.6 percent in relation to GDP.

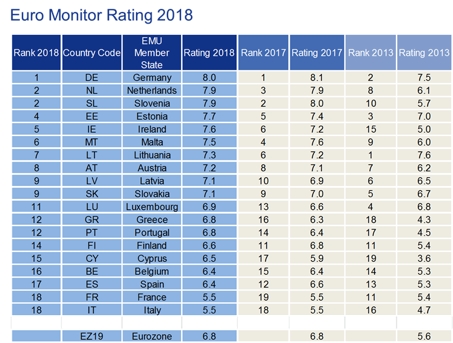

This positive economic development is reflected in the results of this year's Euro Monitor, in which we assess the stability or health of the Eurozone economies on the basis of 20 indicators in four categories: fiscal sustainability, competitiveness, employment & productivity and private & foreign debt. Despite no further improvement in 2018, at 6.8 points, the Euro Monitor rating for the Eurozone sits towards the solid middle of the scale (which ranges from 1 to 10). The last time the Eurozone received a higher Euro Monitor score was in 2001.

However, the Euro Monitor also shows major areas of concern. In 2018, only the Euro Monitor’s level indicator, which aggregates longer-term level parameters, posted a mild improvement. Meanwhile, the progress indicator, which reflects the shorter-term reform advances, actually declined. This trend reversal was largely driven by lower grades for indicators that measure competitiveness, namely the annual change in labor productivity and unit labor costs, as well as the performance of Eurozone exports compared to global trade dynamics.

“When taking a country perspective, it is the four biggest Eurozone economies that are cause for particular concern – albeit for different reasons,” said Michael Heise, chief economist at Allianz.

First there are Italy and France, both of which have largely treaded water over the past decade with their Euro Monitor scores, even as their peers recovered (first from the great financial crisis and then the Eurozone debt crisis). As a result, France and Italy have been the Euro Monitor tail lights since 2016.

Spain, meanwhile, has seen its rating improve notably in recent years. However, reform momentum has reversed markedly in 2018, judging by the deterioration in its Euro Monitor ranking as well as its rating, which saw the country come in third from the bottom just above France and Italy.

“The fourth laggard, as identified by our Euro Monitor rating, is Germany, despite once again occupying the pole position in the 2018 overall ranking. This verdict is based on the sharp deterioration in German reform momentum relative to its peers,” said Heise. In the Euro Monitor’s progress indicator sub-ranking, Germany has fallen back to place 13, mainly as a result of weaker export growth relative to global trade dynamics and barely-there productivity growth. This is Germany’s worst placement since the inception of the euro and down from the second rank it held as recently as 2014. Political complacency is clearly putting Germany’s economic prosperity at risk.

Prospects for further Euro Monitor rating improvements are rather dim. For one, macro imbalances will no longer just melt away as the Eurozone economic upswing continues to slow. In addition, Eurozone reform momentum has clearly passed its peak and is unlikely to reaccelerate any time soon. In fact, the rising political instability at the national as well as the EU level – driven by the surge in populism, evaporating mainstream majorities and the rising fragmentation of the political landscape – is undermining the already-weakened European consensus in favor of macroeconomic convergence and fiscal discipline. This development poses a clear threat to the stability of the Eurozone. Only a marked political rethink, at the national as well as the European level, could help turn this trend around. Without it, the 2018 Euro Monitor results are probably a case of “as good as it gets”.