If one word could describe 2018, ‘turbulent’ would be a pretty good fit.

Fears of economic giants United States and China getting into a trade war kept investors and business leaders on the edge for most of the year. At the recent G20 summit, the two called a 90-day truce. But certain developments after that again raised doubts the peace would last too long.

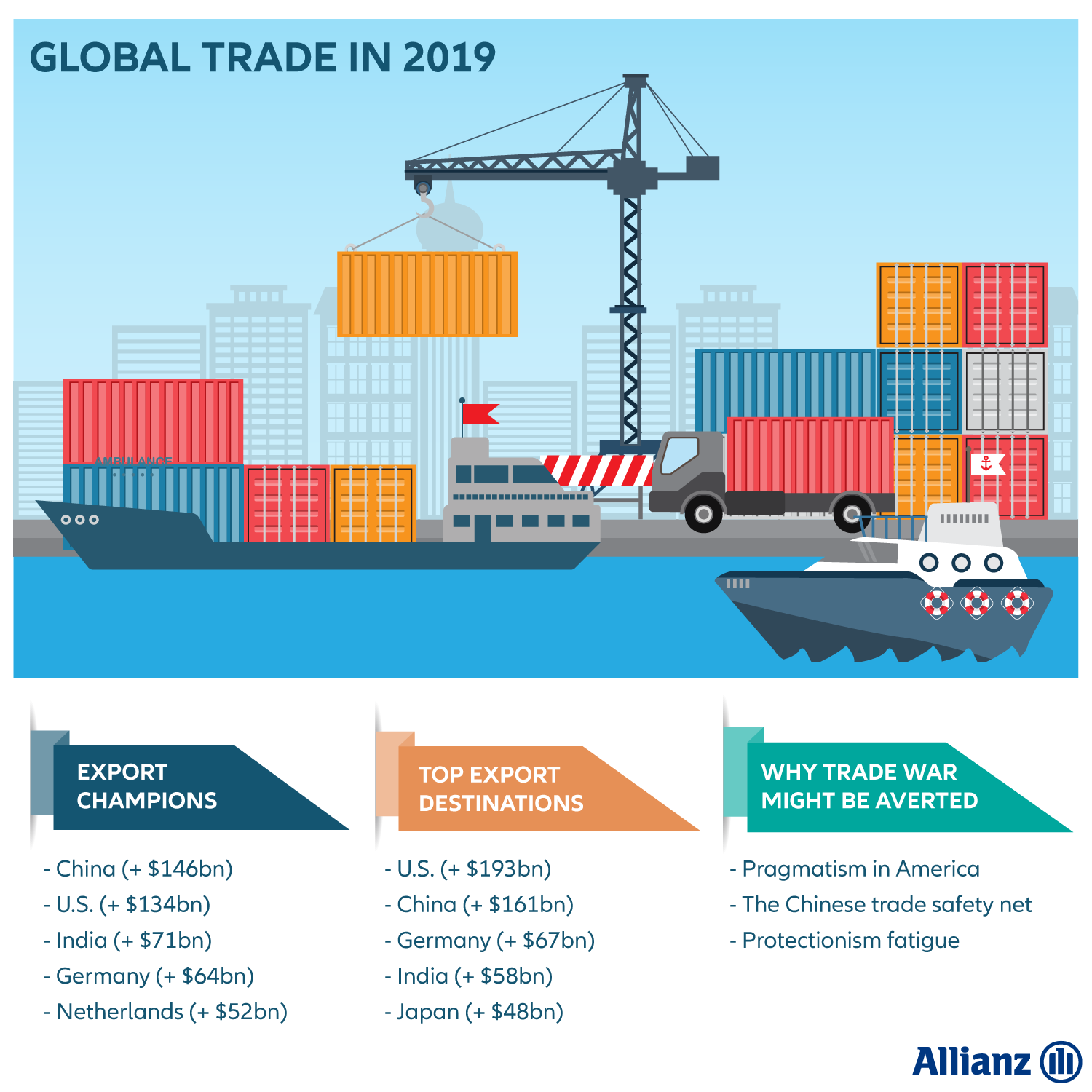

So are there reasons to fear for global trade in 2019? Or can we leave behind the fears of 2018 as the first morning of the new year breaks? In its latest Global Trade Report, Allianz Research does some crystal-gazing for the upcoming year...