By 2020, annual global investments needed to sustain the energy transition consistent with the goal of limiting global warming to 2° Celsius will have risen to $790 billion. Climate-related investments, such as renewable energy, not only help create a sustainable world but also offer sound long-term returns that are generally not linked to the ups and downs of financial markets.

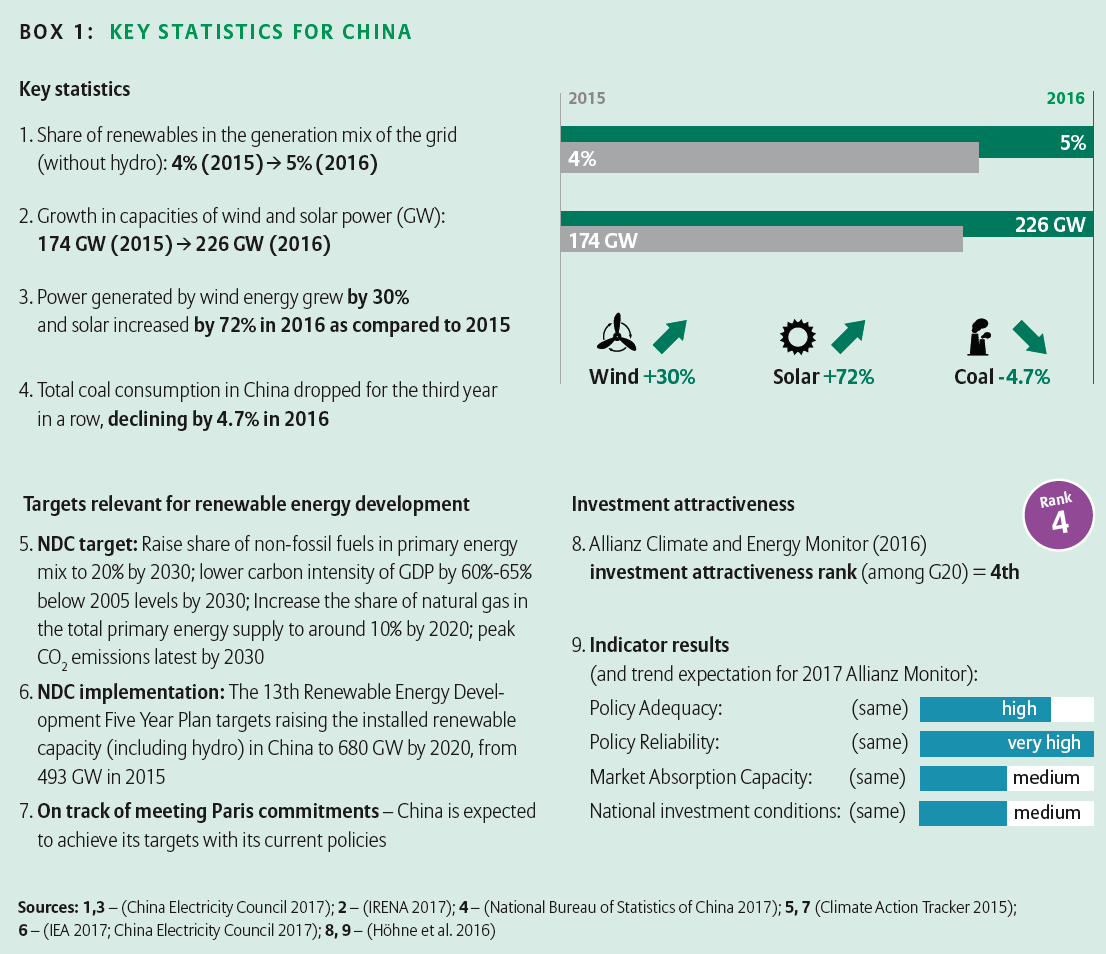

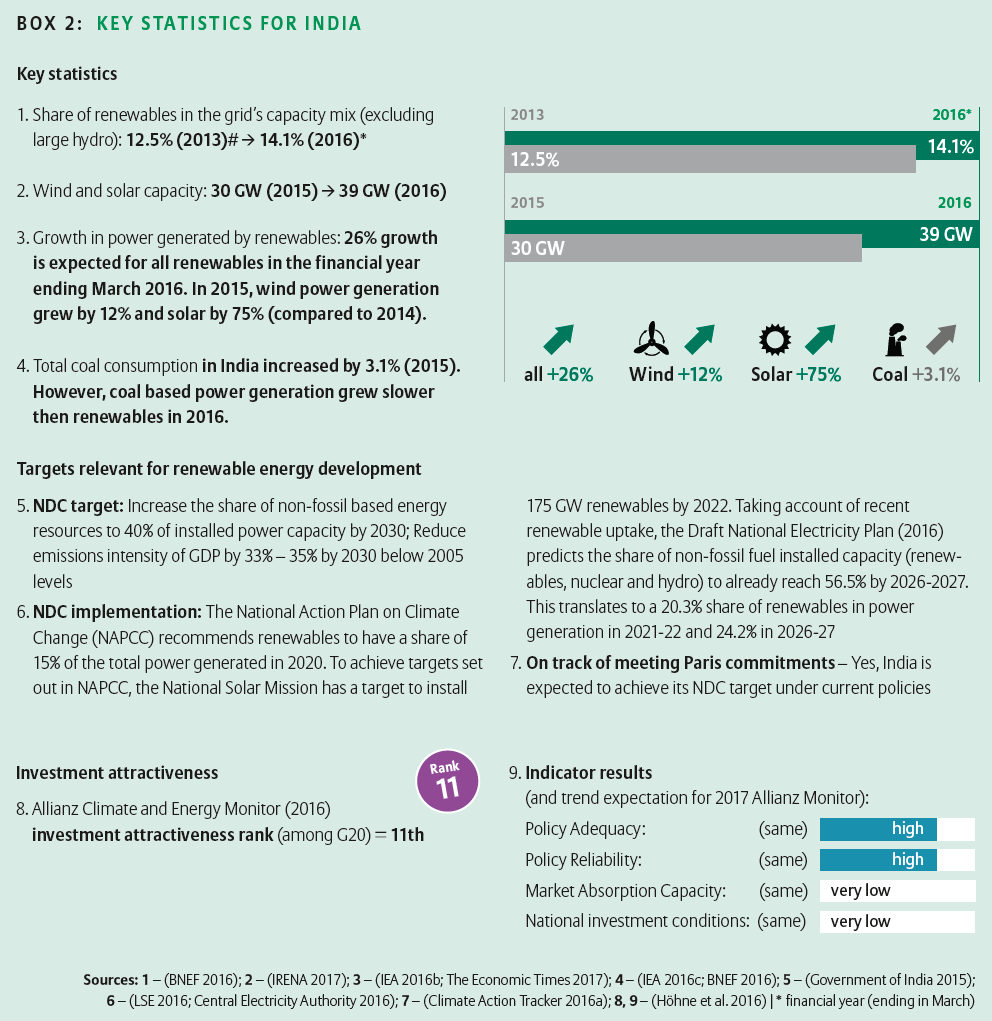

China, India and the United States together account for more than half of the global emissions of greenhouse gases and are the largest markets for renewable energy investments.

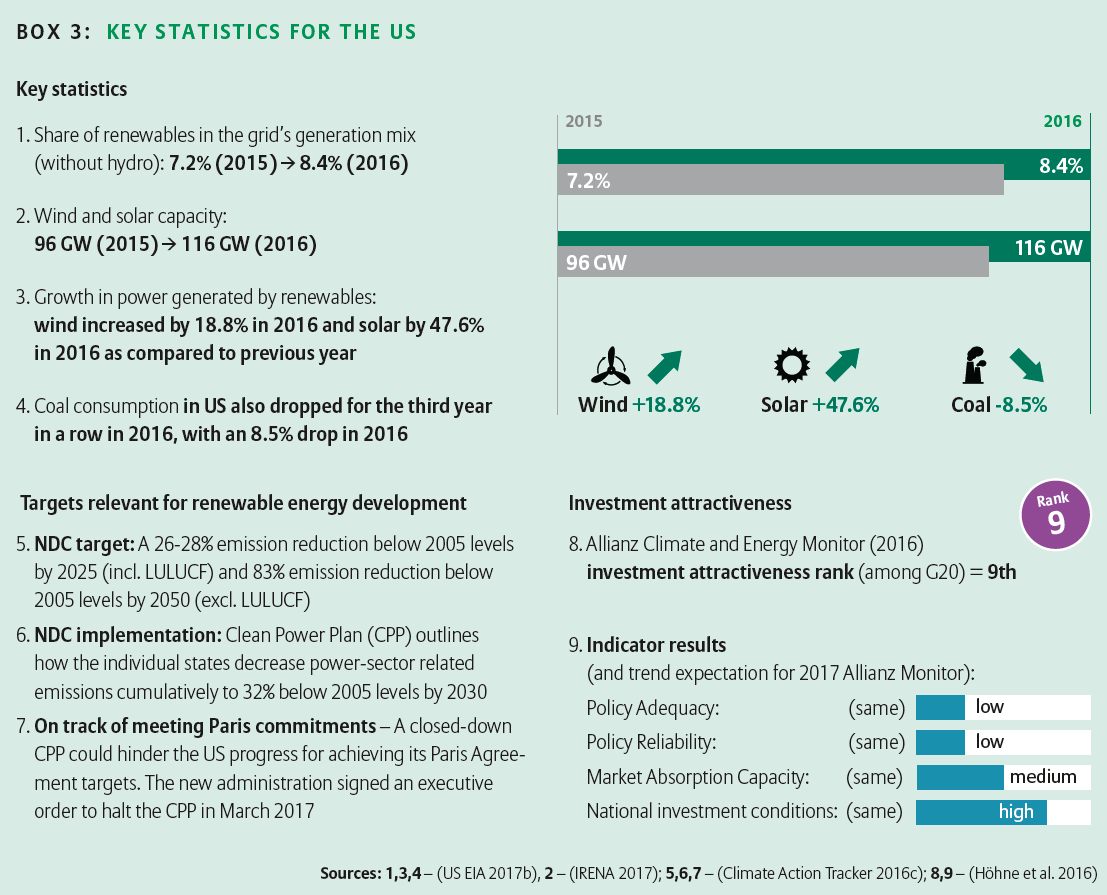

So how have the investment conditions changed lately in these markets? State-level action will be key for the United States as the political landscape changes, while China and India are set to lead the renewable energy transition, says the Allianz Climate & Energy Monitor Deep Dive.