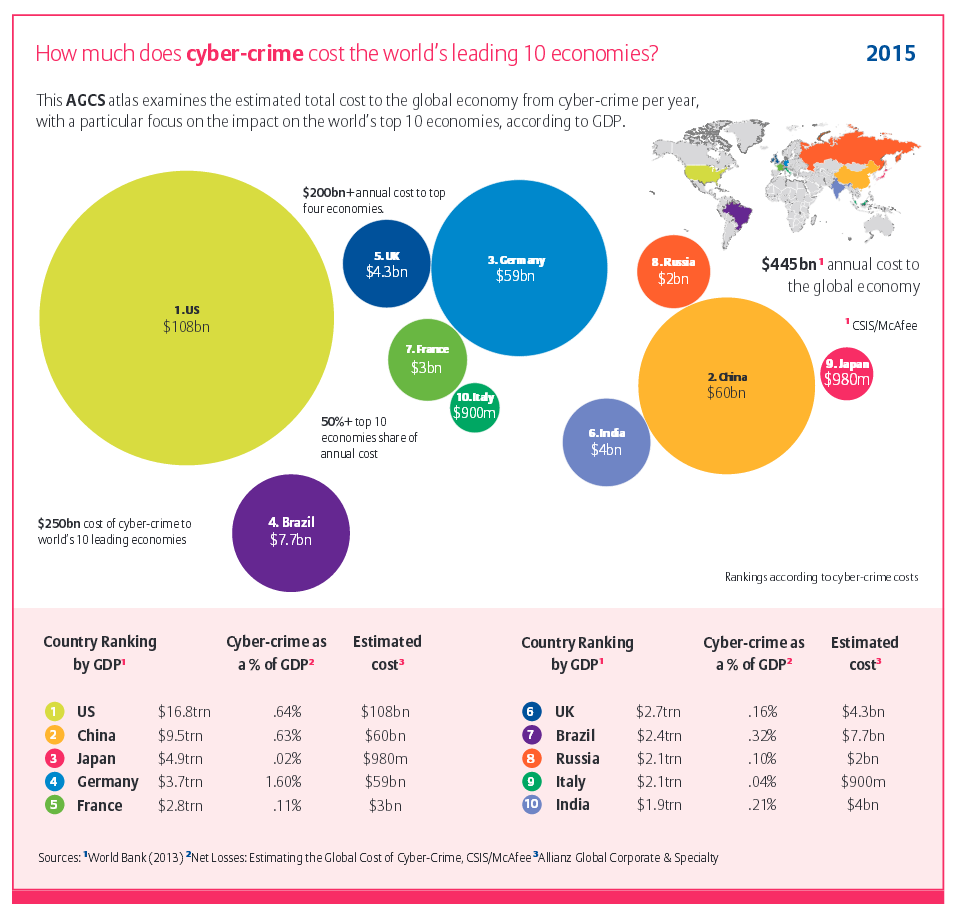

A defective product is recalled around the world. Human error results in a major shipping incident. Credit card data is stolen in a cyber attack. A dam collapses causing significant damage to the environment: Modern corporate liability exposures can arise from a growing number of sources and have the potential to result in larger and more complex losses for businesses than ever before, warns Allianz Global Corporate & Specialty (AGCS) in a new report Global Claims Review: Liability in Focus.

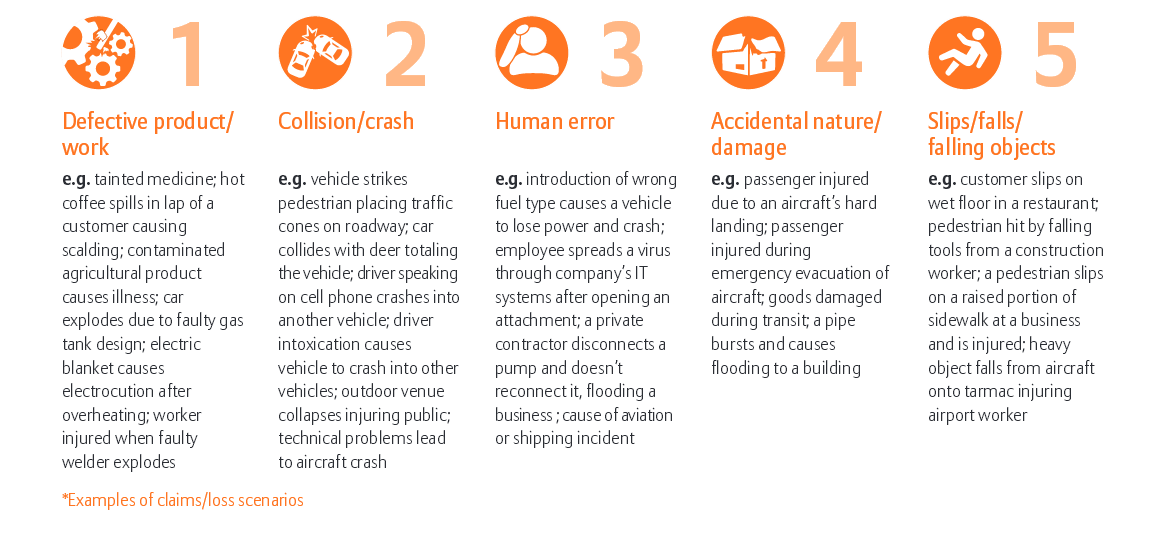

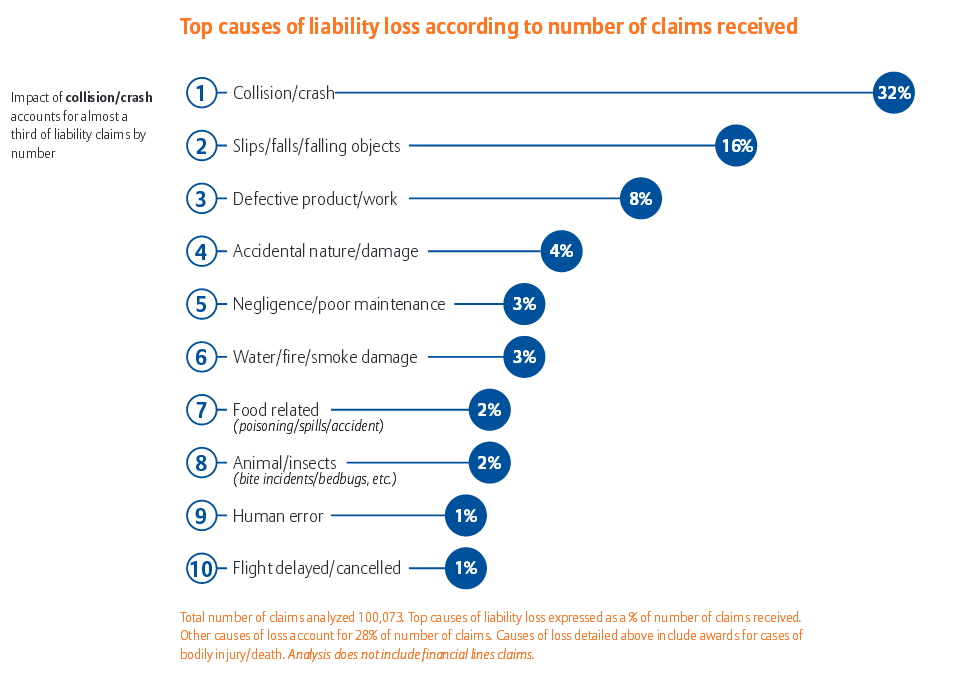

The report identifies defective product or work, crash and human error incidents as the largest causes of liability loss for businesses, based on analysis of insurance claims.

While ‘everyday’ liability claims like slips and falls or workplace incidents have been reducing due to more stringent safety regulations and better risk management, the report says the potential for more expensive liability losses around the world is increasing, particularly in relation to global product recalls, corporate liability, cyber and environmental incidents.

Additionally, new corporate liability exposures will arise from disruptive technologies and the more complex business models of the growing ‘sharing economy’.