Today, Allianz unveiled the sixth edition of its "Global Wealth Report", which puts the asset and debt situation of private households in more than 50 countries under the microscope. Based on the findings of the report, three first-time milestones in financial asset development were passed in 2014: The global net financial assets of private households surpassed the 100-trillion-euro mark, China’s private financial assets exceeded those of Japan, and the number of people falling into the wealth middle class in global terms breached the 1 billion mark. In detail:

Global gross financial assets of private households grew by 7.1 percent in 2014; thus the robust growth witnessed in previous years continued, albeit at a slightly slower pace. Increasingly, growth is driven by households moving up a gear with their savings efforts; in Asia and America, stock markets continued to be a tailwind This brought total global gross financial assets up to a new record level of EUR 136 trillion – higher than the value of all of the world's listed companies and all sovereign debt. “Many observers will interpret these figures as evidence for the so-called savings glut”, said Michael Heise, Chief Economist at Allianz. “But this is the wrong perspective. Against the backdrop of low interest rates, too many households are still not saving enough for old age. Policymakers should not try to restrict savings but find new ways and incentives to promote capital demand. There is no lack of investment opportunities because the challenges that lie ahead are huge: climate change, poverty and migration, digital revolution, outdated infrastructure – to name but a few.”

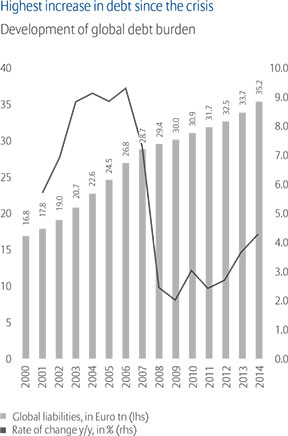

Slower than financial assets, global liabilities of private households climbed by 4.3 percent to total EUR 35 trillion last year, bringing global debt growth up to the highest level seen since the outbreak of the financial crisis. If we subtract debt from the gross financial assets, we arrive at a new record figure for net financial assets of over EUR 100 trillion at the close of 2014, an increase of 8.1 percent on a year earlier.

As in previous years, regional growth in financial assets differs widely. The unrivalled growth champion remains Asia (ex. Japan), where net financial assets grew by 18.2 percent in 2014. The main driving force behind this trend was the sharp (and sometimes not sustainable) increase in securities assets, particularly in China. In the world's other two emerging regions, Latin America and eastern Europe, on the other hand, developments were much more subdued: financial assets increased by 4.2 percent (Latin America) and 8.6 percent (eastern Europe) respectively. Positively, at least from a European perspective: in 2014, the eurozone notched up higher growth than North America for the first time since the financial crisis. The strong growth of 6.2 percent (compared with 5.3 percent in North America) was thanks largely to strict “debt discipline”: In many countries, the cutback of private debt continued in 2014 as well.

Because of Asia, weightings continued to shift

Permanent high growth in Asia has also left its mark on the world asset map, where weightings continued to shift. The region Asia (ex Japan) accounted in 2014 for a good 16 percent of the world's financial assets (gross as well as net). This figure is up by 1.4 percentage points on 2013 and means that the proportion of assets held by this region has more than trebled since 2000. Last year also saw a major landmark being passed as part of this catch-up process: China's total gross financial assets exceeded those of Japan for the first time at the end of 2014. “Recent growth in financial assets in Asia, in particular in China, was really very positive”, commented Heise. “Against this backdrop, a slowdown in growth – as we are currently witnessing – is not worrying at all. China’s catch-up process is by no means over, China today is a different, much richer country than five or ten years ago. The positive impact of China’s rise for the economy and financial markets worldwide is still tremendous.”