The consortium, consisting of pension funds and other long-term investors represented by Allianz, Amber Infrastructure Group, Dalmore Capital and DIF, will invest up to £1.275bn into the Thames Tideway Tunnel via its new special purpose company Bazalgette Tunnel Limited, trading as ‘Tideway’

The investor group includes a significant proportion of UK pension funds through which over 1.7 million UK pensioners will have an indirect investment in Tideway. The Consortium’s backing for Tideway fulfills a key component of the HM Treasury’s National Infrastructure Plan designed to finance the development of UK infrastructure with the support of highly experienced private investors.

Tideway will be the largest single asset in the water sector. An innovative procurement method, combined with the current low interest rate environment, has contributed to significant cost savings for the project, substantially reducing the contributions expected from the end consumer.

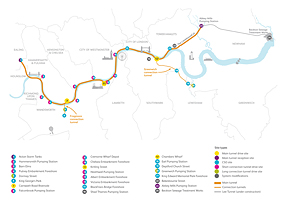

The project will help prevent the 39 million tonnes of untreated sewage currently discharged into the tidal River Thames in a typical year. It will connect 34 existing overflows along the 25km stretch of the Thames, and take effluent – discharged from Acton in the west to Straford in the east – to Becton for treatment. Tideway will rejuvenate the iconic river and ensure the capital’s sewerage system is fit for the 21st century, as well as creating thousands of jobs and helping to boost the economy.

The consortium’s investment vehicle takes its name from Sir Joseph Bazalgette, the pioneering Victorian engineer, who more than 150 years ago transformed the capital, constructing the interceptor sewers to keep sewage out of the River Thames. Still in excellent condition, these remain the backbone of the capital’s sewerage network, but now lack the capacity to cope with the city’s rapidly growing population.

Tideway will operate under the established water regulatory framework, with bespoke features to reflect the nature of the construction obligations. There will also be a mechanism applied after construction to incentivise cost and time savings and from 2030, Tideway will be subject to Ofwat’s 5-yearly regulatory reviews.

Christian Fingerle, Chief Investment Officer responsible for infrastructure investments at Allianz Capital Partners said:

"We are convinced that this major project will modernize a pivotal aspect of London’s essential infrastructure and are delighted that Allianz can help to upgrade London’s sewerage system. This investment will be a very important partnership between all stakeholders and Allianz. Together, we want to achieve a major improvement to London's iconic river."

Allianz invests in London’s Thames Tideway Tunnel

The proposed route of the new tunnel.

Further information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer: