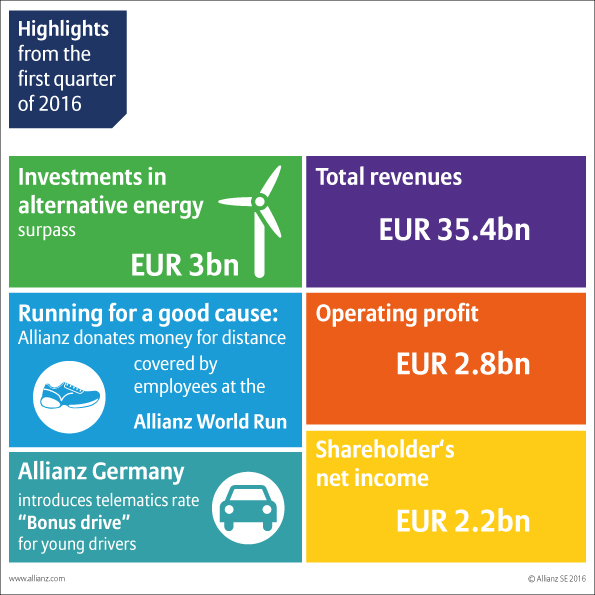

Allianz Group achieved strong results in the first quarter of 2016 in a continued challenging environment. Net income attributable to shareholders rose by 20.5 percent to 2.2 billion euros, driven in part by non-operating realized gains. In the Property and Casualty insurance segment, operating profit showed a substantial improvement compared to the previous year, largely due to lower claims stemming from natural catastrophes. The Life and Health insurance segment recorded a decline of total revenues as a result of changes to the product strategy. In Asset Management, third-party net outflows continued to decrease compared to the prior year.

“The first quarter represented a great start to the year. We are well on our way towards achieving our operating profit target in the range of 10.5 billion euros, plus or minus 500 million euros for the entire year,” said Dieter Wemmer, CFO of Allianz SE.