Allianz.com: 136,000,000,000,000 or 136 trillion euros personal financial assets across the globe – that’s a record. Does that mean that the world saves too much and invests too little?

Michael Heise: No and yes. No, the world does not save too much. Faced with over-indebted governments and aging societies, each individual is being called upon to do more, and not less, to make provisions for his or her own future. But yes, we invest too little – given the challenges that lie ahead: climate change, poverty and migration, digital revolution, outdated infrastructure – to name but a few.

The emerging markets have been seeing a downturn in recent weeks – what does that mean for the middle classes in these countries?

What we are seeing at present is that the rapid catch-up process with the emergence of a strong middle class is slowing down only slightly, even in China. The growth of the middle wealth segment is a stabilizing factor for the economies. China´s consumption, for example, is continuing to grow at a double-digit rate. In a long-term perspective the growth of prosperity will however depend on whether structural reforms will be carried out.

3 questions, 3 answers

“Too many people are left behind”

Download

Michael Heise, Chief Economist at Allianz: “The growth of the middle wealth segment is a stabilizing factor for the economies.”

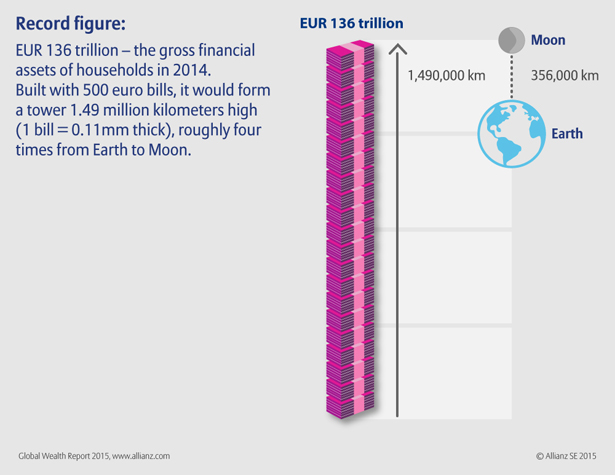

136 trillion euros in private assets worldwide: the figure reported by the Allianz Global Wealth Report sets a new record.

Download graphic

Download graphic

According to your calculations, the gap between the rich and the poor is getting bigger and bigger in the developed countries. What does that mean for the economic development of these societies?

In terms of wealth distribution, the developed countries in Europe, North America and Oceania paint a very heterogeneous picture. Most of these countries, however, have seen a (sometimes considerable) increase in the inequality of distribution in financial wealth. This holds especially true for the US and the political debate there is sure to go on. Rising inequality puts social cohesion at risk and it can be an impediment to growth. But the challenge is not to curb wealth accumulation at the top, the “problem” sits at the bottom: too many people are left behind. The real challenge, therefore, is to bring them back into the game, first and foremost by better education and flexible labor markets offering employment.

In terms of wealth distribution, the developed countries in Europe, North America and Oceania paint a very heterogeneous picture. Most of these countries, however, have seen a (sometimes considerable) increase in the inequality of distribution in financial wealth. This holds especially true for the US and the political debate there is sure to go on. Rising inequality puts social cohesion at risk and it can be an impediment to growth. But the challenge is not to curb wealth accumulation at the top, the “problem” sits at the bottom: too many people are left behind. The real challenge, therefore, is to bring them back into the game, first and foremost by better education and flexible labor markets offering employment.

Further information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer: