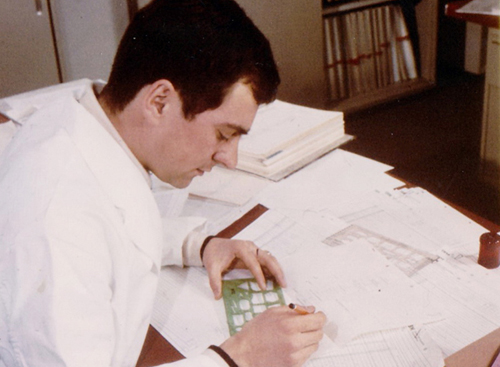

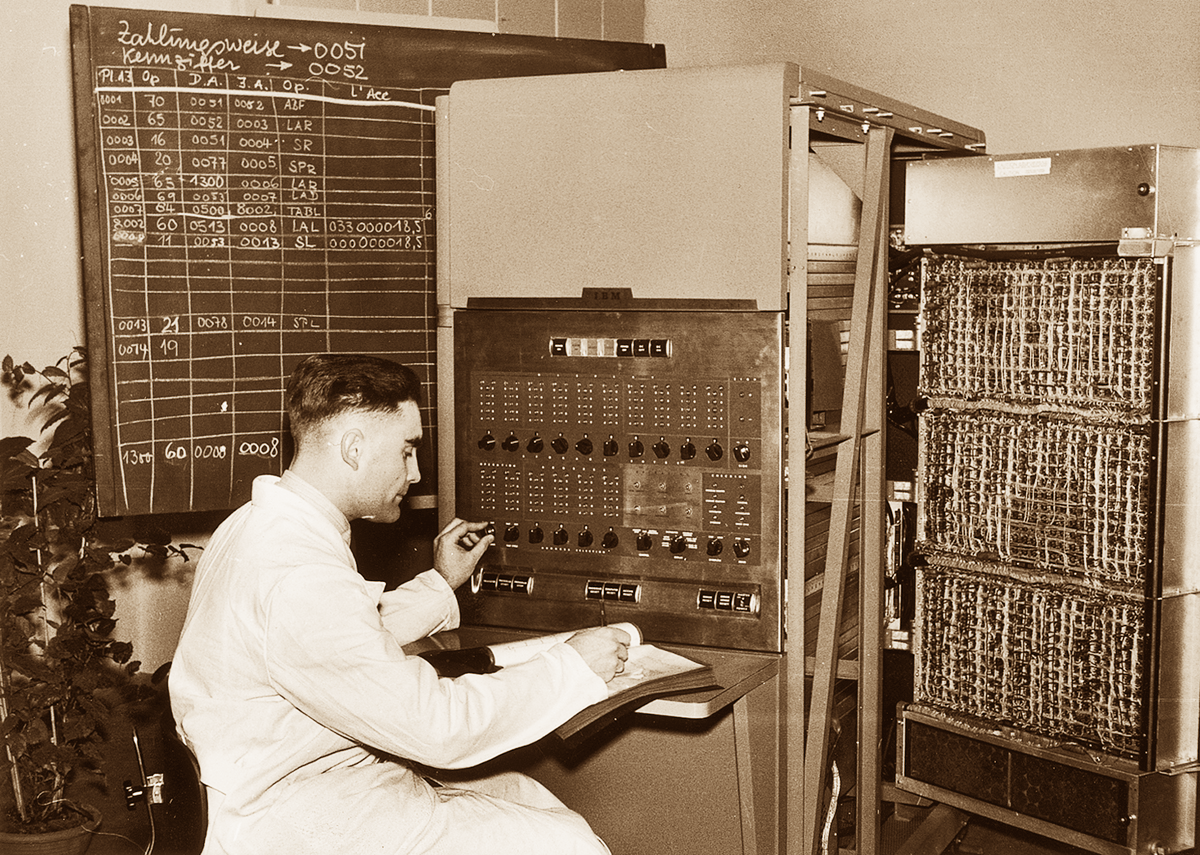

Alexander Metz can clearly remember the day he started working – it was the day man first walked on the moon. Aged 23 in 1969, Alexander was fresh from university with a degree in what was then the exciting new field of computer programming. He was attracted to Allianz because it enjoyed the reputation of being on the cutting edge of technology. The company had just bought a third-generation IBM/360 system with an insane memory of 256KB! Alexander couldn’t wait to work on it.

Forty years later, when he retired from Allianz, the work environment had drastically changed. Women were starting to move into managerial positions, the canteen had become a self-service instead of a sit-down three-course meal, and your name was no longer ticked off by your department head every morning. In 1969, Alexander had helped install the first ever computer screen at Allianz, but by the time he left, everyone had at least one on their desk and the latest mobile phones provided to employees were about 500,000 times more powerful than that original mainframe.

Today, when the ‘future of work’ is on everybody’s mind, it helps to look back on how workplaces have constantly been undergoing change. For example, young employees take the Internet for granted, but it was only around the year 2000 that it really got going. Before then, if you wanted to send someone a business message, it went by internal post or – if urgent – by pneumatic tube, a system of pressurized air tubes that ran throughout Allianz buildings. As for social messaging, back in the ‘60s, no personal phone calls were allowed during work hours and even chatting at the workplace was frowned upon.