For climate change, 2016 was a milestone year.

In November, the Paris Agreement entered into force and representatives of 195 countries discussed topics ranging from ways to cut industrial pollution to adapting coastlines to rising seas levels at the UNFCCC Conference of the Parties in Marrakesh, Morocco.

There were headwinds too.

The new political leadership in the United States has announced plans to dismantle environmental policies in the world’s largest economy and has questioned its Paris climate commitments.

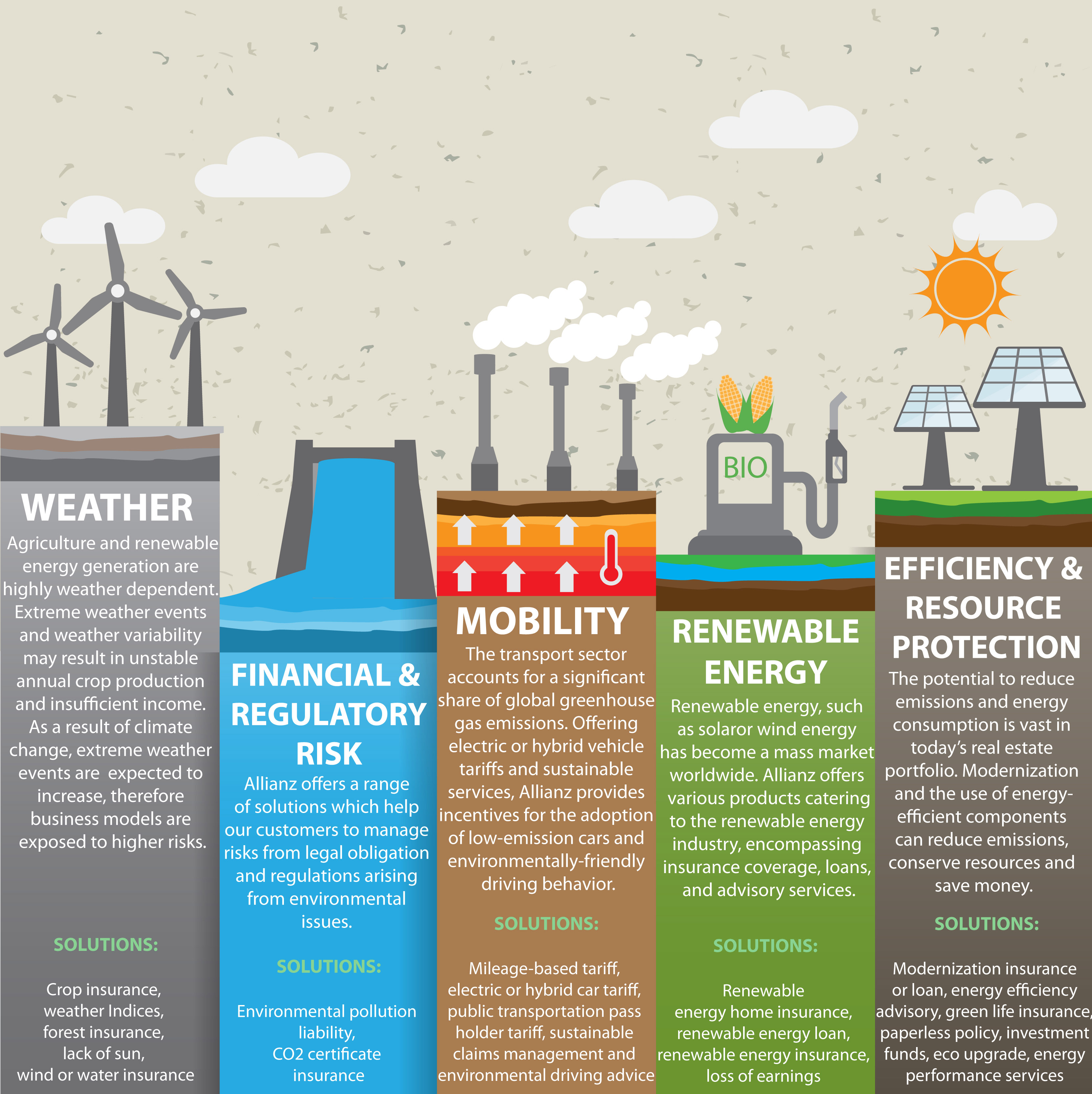

Any conversation on sustainability is incomplete without a discussion on climate change. At Allianz, we have not only been actively participating in these conversations but also taking steps on a company level to do our bit.

A quick look at some of our initiatives...