Angga Yudhistira’s dream was to set up an environment-friendly eel cultivation business. The assistant researcher at IPB Bogor University in Indonesia readied a business plan to make his dream come true but lacked the funding. He found a friend in Allianz Indonesia’s Trust Network Finance (TNF).

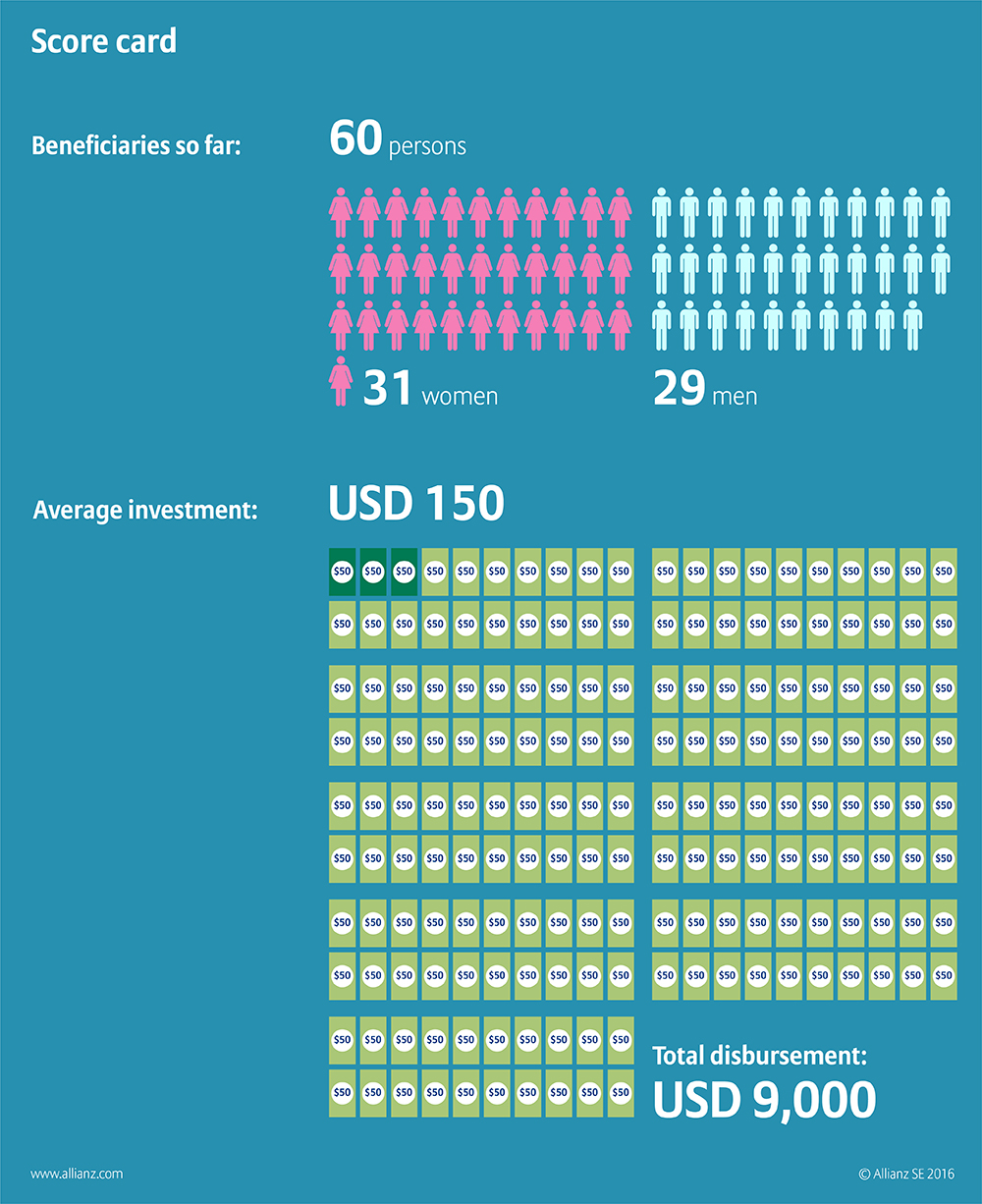

The financing initiative, introduced this year, offers small investments to help Indonesian micro-entrepreneurs grow their business. At the end of August, three days after receiving Yudhistira’s application, TNF disbursed his payment through a digital transfer. He spent it on eel seed.

Agung Nugrohob, a 31-year-old owner of a raw chicken stall in Bogor, has a similar story to tell. Tired of renting equipment, he used TNF funds to buy his own. He diversified his business by adding a frozen beef inventory and developed a side business as a distributor of small gas cylinders.

TNF’s business model differs from conventional micro-lending in that it starts to earn money only when someone’s business takes off, says Auxentius Cahyo Bintoro, manager of Emerging Consumer business at Allianz Indonesia.

It’s a small, but significant difference. Providing a grace period as short as two months - in which start-up founders like Yudhistira are free to suspend repayments – not only increases business investments in the short run and profits in the long run, but also brings down default rates, according to a study in the American Economic Review in 2013. “The results indicate that debt contracts that require early repayment discourage illiquid risky investment and thereby limit the potential impact of micro-finance on micro-enterprise growth and household poverty,” the researchers wrote.

TNF has a grace period of three months, during which these entrepreneurs don’t have to make repayments..