The complex offers 360-degree views of Barcelona and the Mediterranean coast as well as excellent transport connections, with two metro stations and the beach within walking distance. The building’s main tenant is a large IT consultancy, a subsidiary of one of Japan’s largest public companies.

The two buildings meet Carbon Risk Real Estate Monitor (CRREM) standards and are compliant with EU Taxonomy. As such, the acquisition fully supports Allianz Real Estate’s global ESG programme, which aims to reduce carbon emissions across its portfolio by 25% by 2025 and be carbon net-zero by 2050.

Allianz Real Estate believes that well located office assets with strong ESG profiles in key cities will remain in high demand from tenants. In Allianz Real Estate’s recent Cities That Work 2021 office sector report, Barcelona was highlighted in the Cities to Watch category. In addition to being an important European transport center, the city offers far-reaching cultural exports and a fast -growing tech ecosystem.

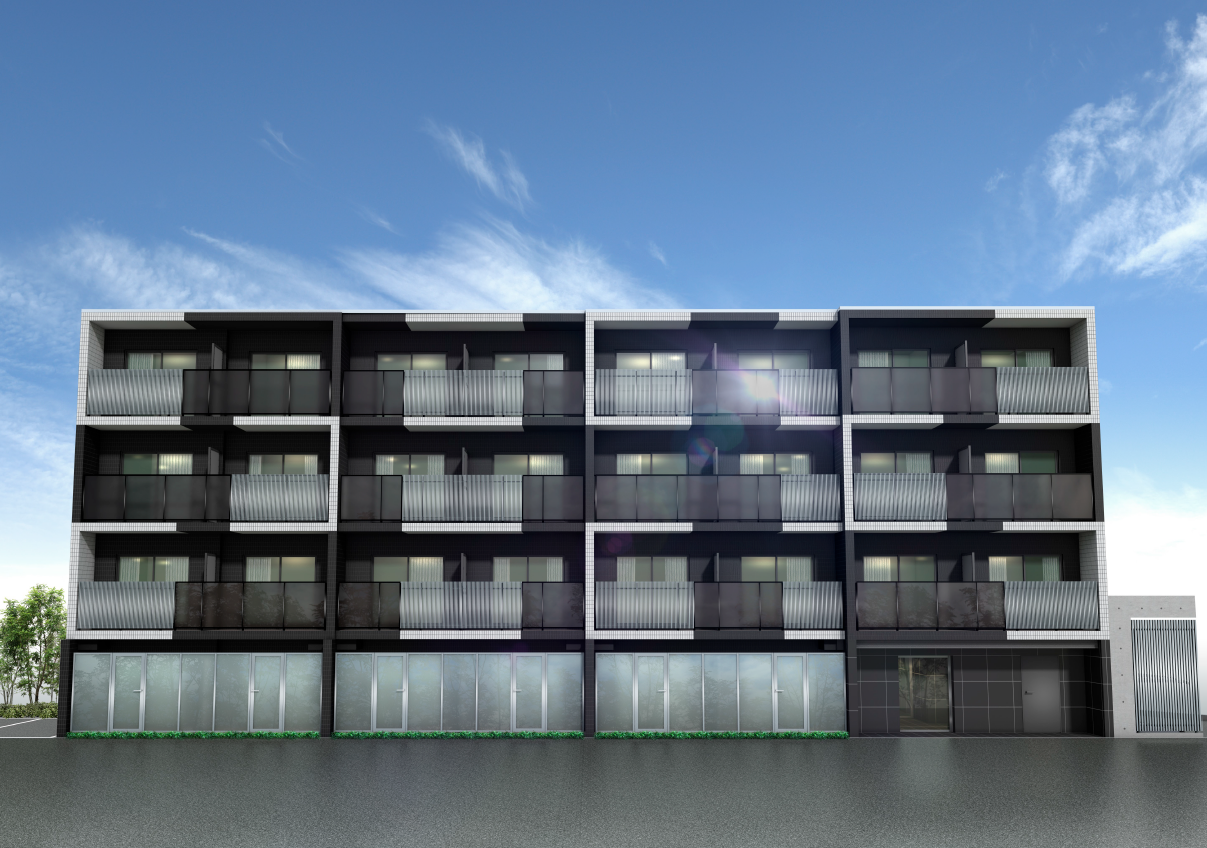

Allianz Real Estate has significantly increased its allocation to Madrid and Barcelona in recent months, with two transactions that expanded the firm’s exposure to the attractive Spanish PRS sector. In June 2021, it acquired 421 prime residential units in 21 assets located in Madrid and Barcelona through the purchase of a controlling stake in a joint venture vehicle owned by several prime investors.

Last month, it acquired nine residential buildings in Madrid in an off-market transaction for EUR 185 million. The asset is located next to Castellana 200, a mixed-use office and retail asset already owned by Allianz Real Estate.

Miguel Torres, Head of Iberia, Allianz Real Estate, said: “Offering and creating spaces that reflect the changing needs of occupiers, who are looking to spend their time in a more social and sustainable environment, is key to our investment strategy. This complex represents the best of what Allianz is looking for in the office segment: large, class A properties in a prime location with top ESG standards which enable tenants to attract and retain talent. We are very pleased to have worked with Meridia on this transaction and look forward to future collaborations.”

Alexander Gebauer, CEO West Europe, Allianz Real Estate, said: “Barcelona continues to escalate in significance as an economic, cultural and social hub, and we’re delighted to be increasing our exposure to one of Europe’s most exciting cities. The fact we have again been able to complete an off-market transaction in such a market underscores the strength of our local presence and network.”