Allianz Real Estate expects to further expand its logistics portfolio in 2022, ramping up its activity in Europe, the U.S. and in the fast-growing Asia-Pacific region, all of which are benefitting from strong tailwinds engendered by its significant adoption of e-commerce.

Karen Horstmann, Head of Acquisitions United States at Allianz Real Estate added: “Our focus is on the development of state-of-the-art facilities through both equity partnerships with leading operators and debt financing, honing in on prime, sustainable assets located strategically in and around urban areas – not only in Europe which has seen a plethora of activity over 2021, but in the U.S. as well, which currently serves as the world’s most-developed logistics market. Tenants leased more than one billion sq ft of U.S. space in 2021 alone, almost half of which is net absorption – the highest level in at least three decades, despite net asking rents also being at an all-time high. With compelling fundamentals reshaping the commercial sector, we look forward to further expanding our portfolio in the region and beyond as we head into 2022.”

The acceleration of e-commerce, a structural trend that gained momentum as a result of the pandemic, is expected to remain for the long-term.

Danny Phuan, Head of Acquisitions Asia-Pacific at Allianz Real Estate concluded: “The logistics sector has come out of the Covid-19 recession stronger than ever. The pandemic has given momentum to e-commerce adoption, with global e-commerce sales rising to EUR 2.1 trillion as at the end of 2020 – marking a 140% increase in just five years*. Outperforming all other sectors over a five-year period, the sector is expected to remain resilient in 2022 due to robust, persistent trends, including increased consumer delivery demand as well as supply chain re-configuration.”

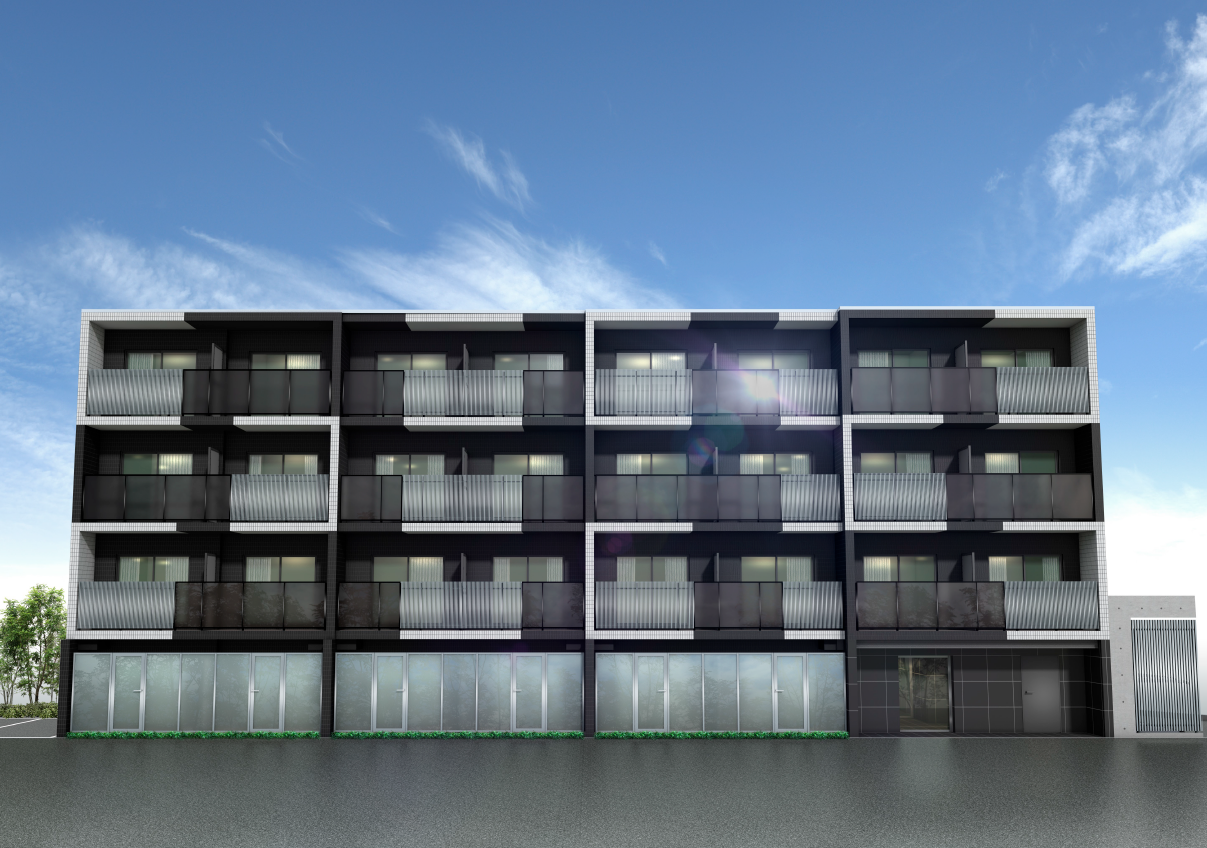

“With dense cities having scarce available land, an innovative approach to logistics will be required as we navigate 2022 and beyond. If the demand for last-mile facilities and land values remains high enough, we think multi-story warehousing may become more popular, as will mixed-use buildings with logistics included*. We are well positioned to lead the sector in the development of these new assets.”

Click here to read Long-term demand drivers behind logistics real estate, our latest report on the sector authored by Allianz Real Estate’s Research team, led by Dr. Megan Walters.