An odd piece of cargo is trundled over the cobblestones of the Greek port of Piraeus before being wheeled up the gangway to a docked merchant ship. In size and shape, it’s a modern version of a steamer trunk, the type of luggage favored by world travelers in the 19th century. But what it really contains is a small piece of the future of medicine.

Modern technology has shrunk the world, making it possible to be in nearly continual communication from ship to shore. But seafaring remains a high-risk occupation in a remote, isolated environment. When medical issues arise, they can quickly exceed the training of ship officers, whose competencies extend to applying bandages, placing intravenous access, suturing wounds and administering strong painkillers.

How telemedicine is changing healthcare

Doctor On Deck

Related links

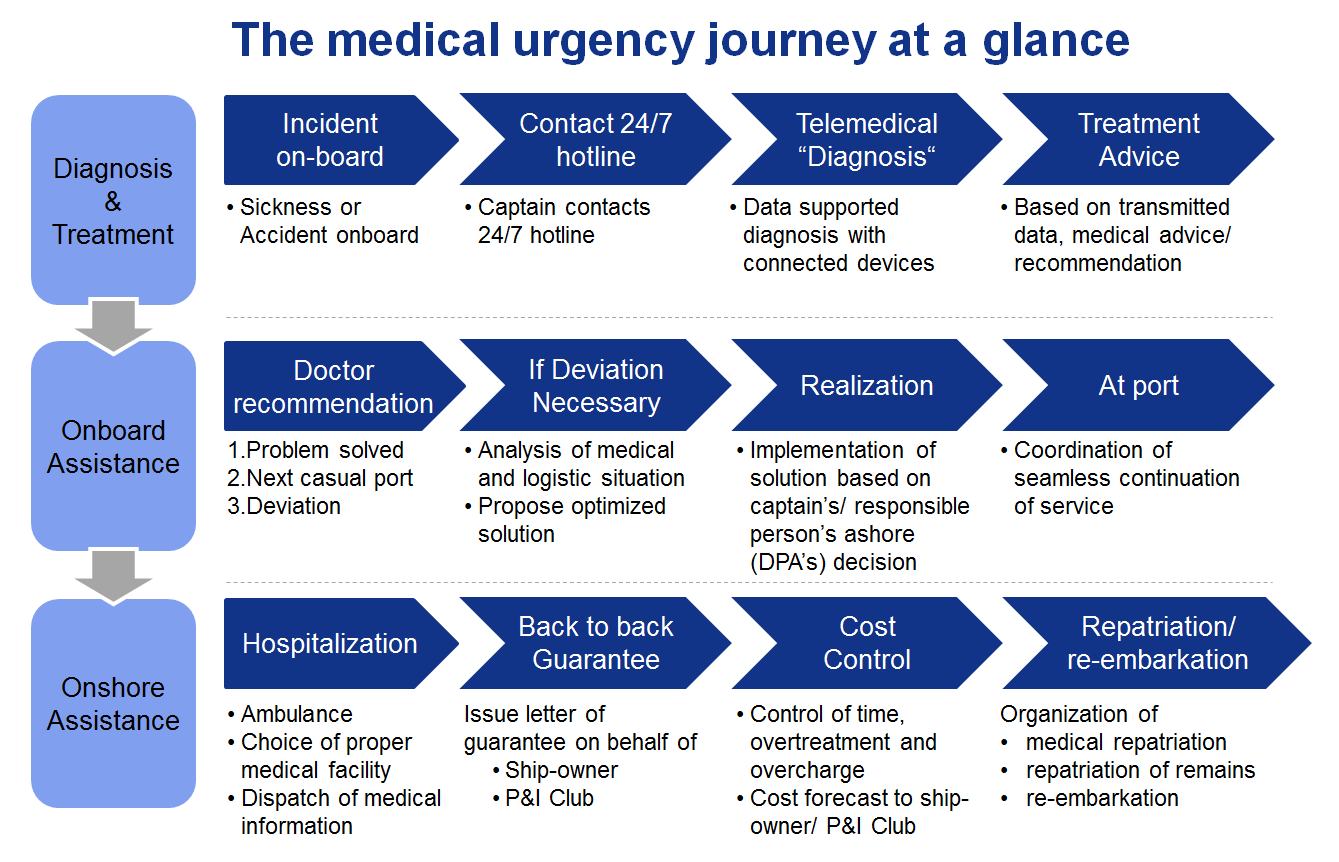

Immediate assessment and diagnosis are critical if emergency deviation to port is required. This is where the Telemedicine Case – the solution inside the cargo – comes into play. Inside is a diagnostic tablet that connects via Bluetooth to a range of digital devices including a cardiograph (ECG), blood pressure meter, thermometer and oximeter.

Also included are troponin (protein) and glucose tests, as well as an otoscope to examine the eardrum and outer ear. If an emergency arises, the ship’s captain or officer can reach a 24/7 medical team with specialists and doctors. Under guidance, the officer runs a series of fact and measurement-based diagnostics while the tablet collects the data and sends it to the support center for analysis and action.

For the crew member, the solution provides almost “real-time” medical treatment; for the captain, it can reduce liability for medical cases; and for the shipping company, it helps avoid unnecessary deviation costs of around $10,000 per day. Such telemedicine assistance can be implemented in other isolated environments, such as mining or exploration camps. Doctors Without Borders uses telemedicine five to ten times a day to seek advice from its 280 specialists around the world on difficult cases in remote, often war-torn areas.

FROM SEA TO LAND

We are, however, at a point where telemedicine solutions will have far wider applications throughout society. The demographic and social changes that western societies are undergoing means that many once-populous areas are being drained of people. Meanwhile, those that remain – often the elderly and the young – face increasing isolation and declining local services.

In France, people living in the countryside often face waits of weeks or months if they want to consult a specialist. It is not difficult to imagine that the digital revolution represented by the Telemedicine Case could be used to bridge critical gaps in services for local communities.

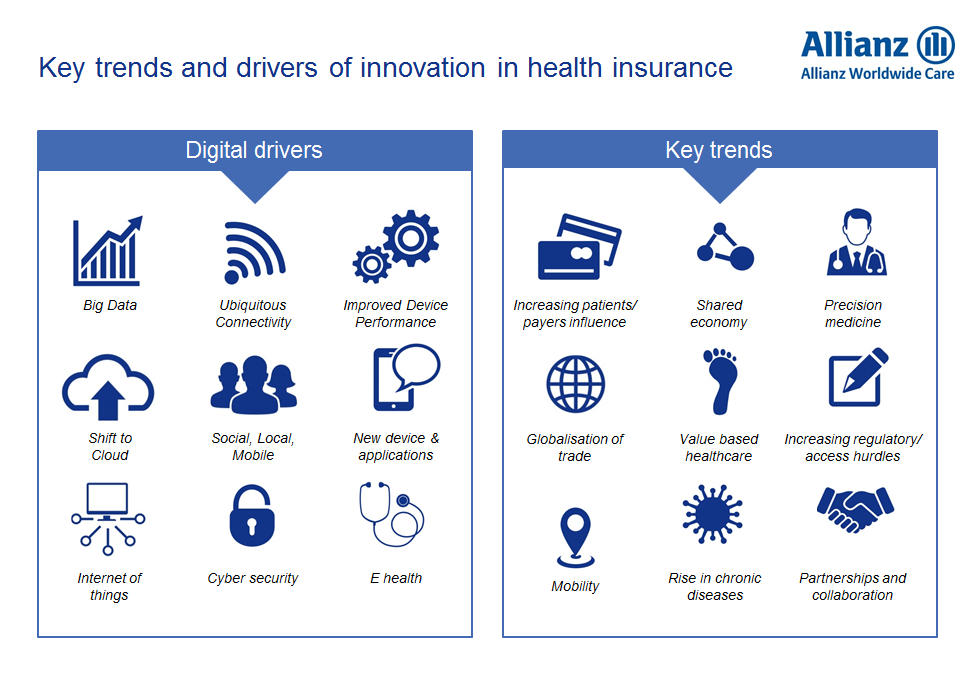

When you examine the technological trends that are coming together – remote diagnosis capabilities, cloud storage and support algorithms that assist doctors during diagnosis – you can see the way healthcare and, ultimately, health insurance provision is changing.

No one who buys health insurance actually wants to invoke the policy. Given the choice, people would rather be healthy. Today, we have this potential literally in our hands. Apps on the smartphones and tablets we all use have the ability to collect data on our wellbeing. Combined with more comprehensive analysis, such as a regular visit to a doctor, this can help build a total picture of an individual’s health.

SWITCH FROM CURATIVE TO PREVENTIVE

This information can enable individuals to have more direct control over their health. It also helps create a system that is not only curative but works to prevent people from becoming sick. Providing individuals with more control over health measurement and linking this to medical and insurance systems can allow for in-time interventions.

Is this painting an unrealistic view of the future? Not really. In 2015, there were 800,000 virtual consultations in the United States alone. In 2016, according to BCC Research, this nascent global telehome and telehospital/clinical market was estimated to be worth nearly $23.8 billion and is expected to grow to $55.1 billion by 2021.

Clearly, people are willing to embrace remote consultations. When powered by fast Internet connections, linked to smart devices and supported by changing insurance standards, this will lead insurance more in the direction of healthcare services. In the early stages, patients can use devices to monitor blood pressure, heart rate and other vital signs and send the data to their doctor, who can provide health coaching and preventive programs. In the primary care and diagnosis stage, it is possible to provide tele triage and telemedicine advice, while in the treatment stage technology can assist with disease management and medication adherence, as well as with outpatient and ambulatory care.

As populations age, such solutions will play an important role in providing continuance in quality service while preventing an explosion in healthcare costs. Doctors are already able to link up with patients by phone, email and webcam on Skype. Today, prescriptions can be delivered online and even linked to pharmacies so that medicines can be delivered to your door. This is a vision that is not so much rapidly approaching as already here and being rolled out. It will fundamentally change the way you receive healthcare.

The article was produced by PROJECT M, a magazine by Allianz on asset management and insurance. It will be published in the June edition of the magazine.

Ida Luka-Lognoné is the CEO of Allianz Worldwide Care, a specialized brand of Allianz Worldwide Partners. With over 20 years experience in the insurance industry, Ida oversees the strategic direction of Allianz Worldwide Care, which provides health, life and disability insurance solutions as well as health and protection services, on a global scale.

Further information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer: