Two things are clear:

- Climate change is creating risk on an unprecedented scale. While insurers must continue to promote and develop coverage options based on accurate risk assessments in and outside of flood zones, the role of insurance companies doesn’t end there.

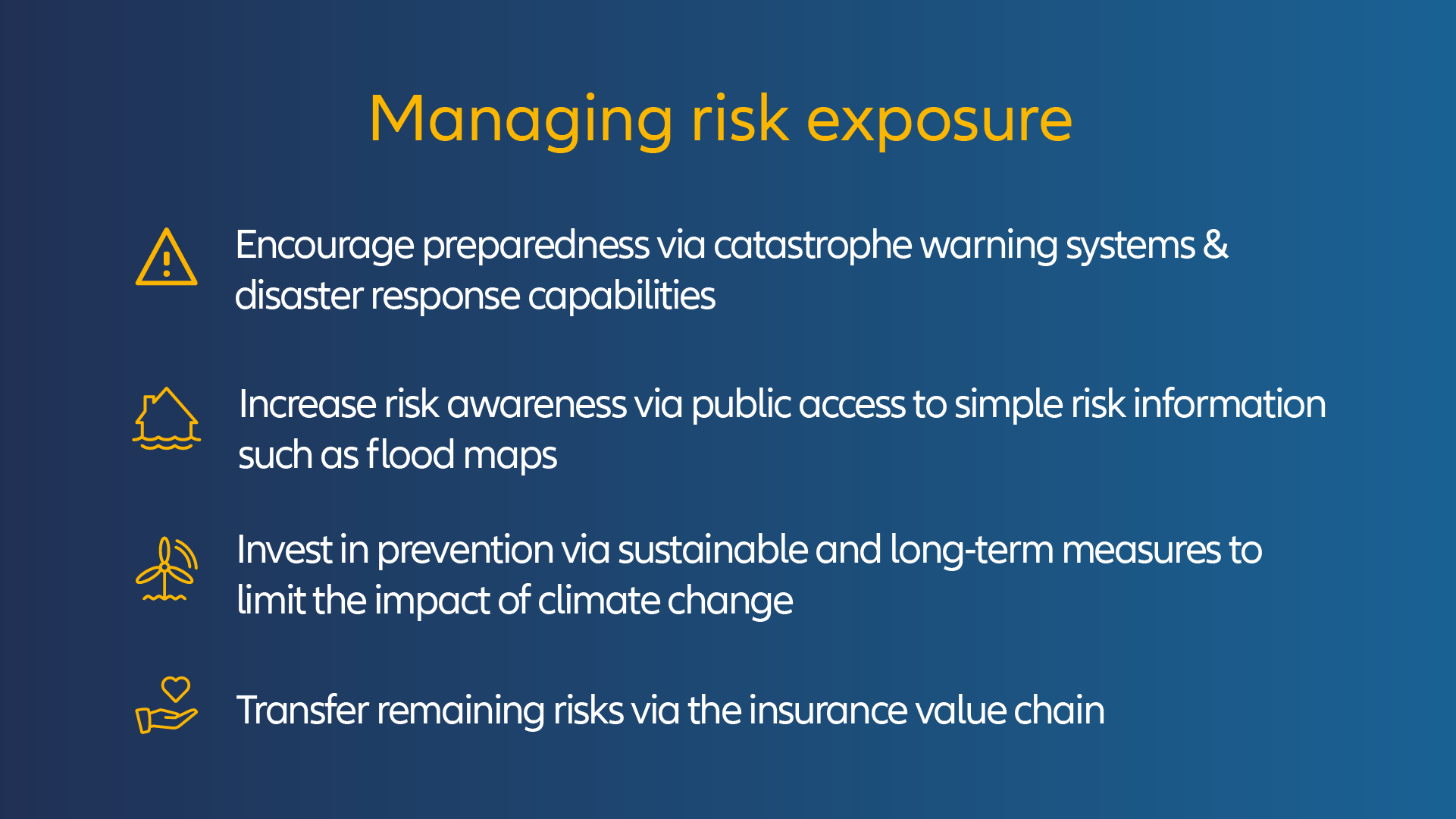

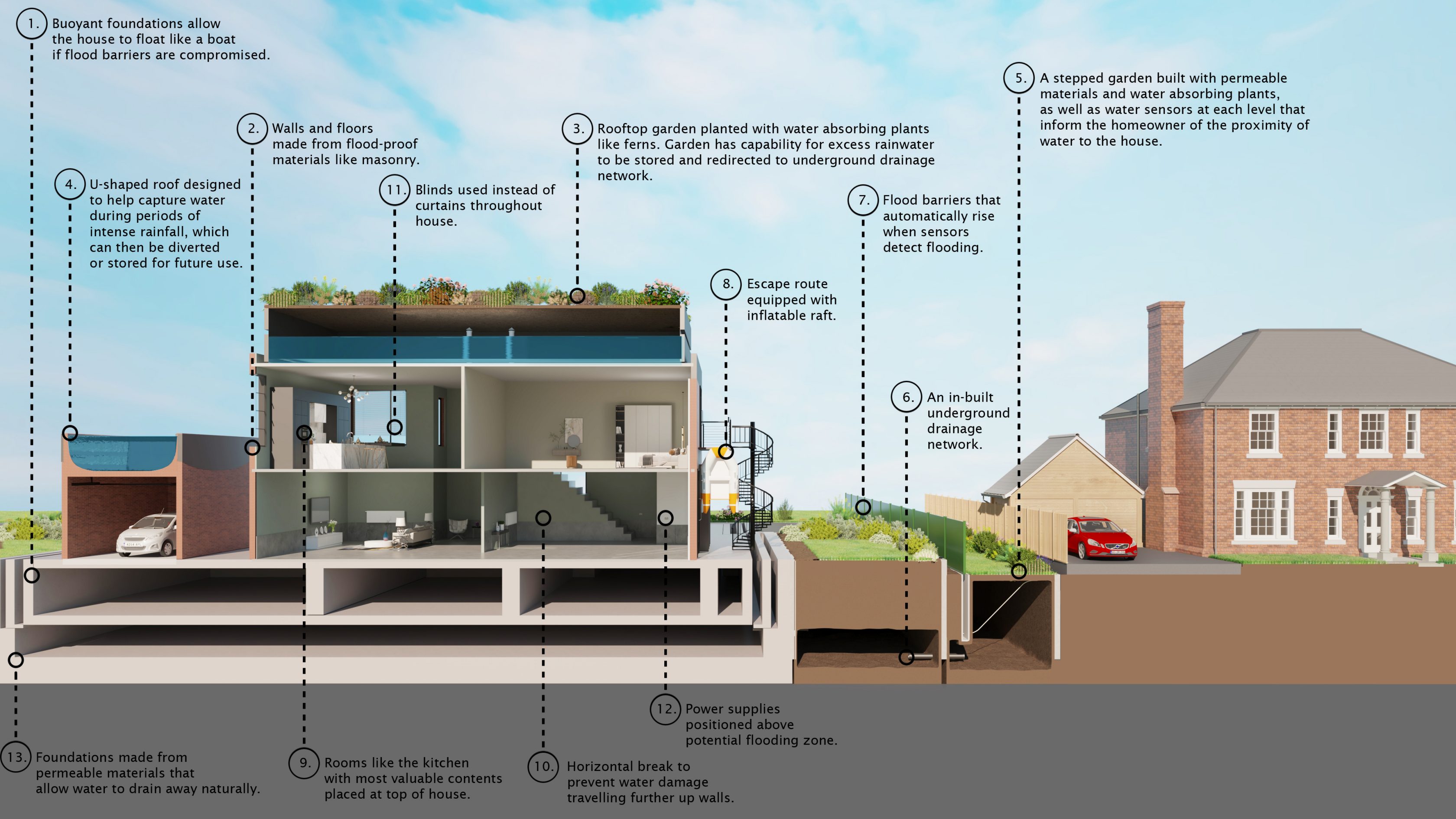

- Extreme weather events cannot be prevented, but the degree of their impact can be significantly reduced. Preparedness in order to minimize the loss of life and property is key.

According to Prof. Dr. Michael Kunz, Spokesman for Disaster Management and Risk Reduction at the Karlsruhe Institute of Meteorology and Climate Research, it’s all about increasing resilience. “An essential component of resilience is the risk competency of each individual, which leads to rapid and appropriate actions of the population when a disaster occurs. Acquiring risk competency starts in school but should also be incorporated into the dialogue of different populations and stakeholders – and, of course, in the insurance sector,” says Kunz.

It’s a long-term view shared by Christopher Townsend, Member of the Board of Management of Allianz SE. “Indeed, it is our responsibility as an insurance company to understand local risks, both so that we can sustainably insure them and provide risk advice to society and customers in order to build resilience. This is why our experts around the world research and analyze the risk profiles of natural catastrophes in all countries where we conduct business.”

Ultimately, it is a combination of insurance and preparedness that will protect communities in the long run, especially in the face of a long battle against climate change. For Klaus-Peter Roehler, member of the Allianz SE Board of Management, it’s clear that smart working together is essential. “A viable solution involves a holistic approach; collaboration across science, business and politics, but also right down to the individual level,” says Roehler. “It has to include elements such as individual prevention, intensive flood protection, a rethinking of building and land use planning, warning and rescue systems, as well as insurance solutions for the broad population and their affordability. Political support is essential, especially when it comes to heavy rain and flood risks. Here, stringent restrictions on building in floodplains play a central role, as do flood protection and river basin management.”