If you ever played Tetris during the 80s or 90s, when the game took the world by storm, you knew that no matter how good you got at it, the game would eventually get the better of you. You started off by neatly stacking your basic blocks, but as the speed of the game picked up, your screen soon got filled with mismatched blocks that didn’t fit and it began to dawn on you that you just crossed that point of no return. Before you knew it, it was game over.

The speed at which Tetris kept throwing those blocks at you, made it impossible to manage. The Covid-19 pandemic entered the stage in a somewhat similar fashion. It was an epidemic as it emerged. Like many we’ve seen before, we thought of it initially in local terms, as something manageable. We soon realized that it was spreading too fast and at dire consequences. It didn’t take long before it became a pandemic. The word itself comes from Greek (‘pan’ meaning all and ‘demos’ meaning people). It spread fast and worldwide and was an outbreak that paralyzed and harmed our health, families, countries, and economies. Many businesses went bankrupt and as a result, many people lost their jobs.

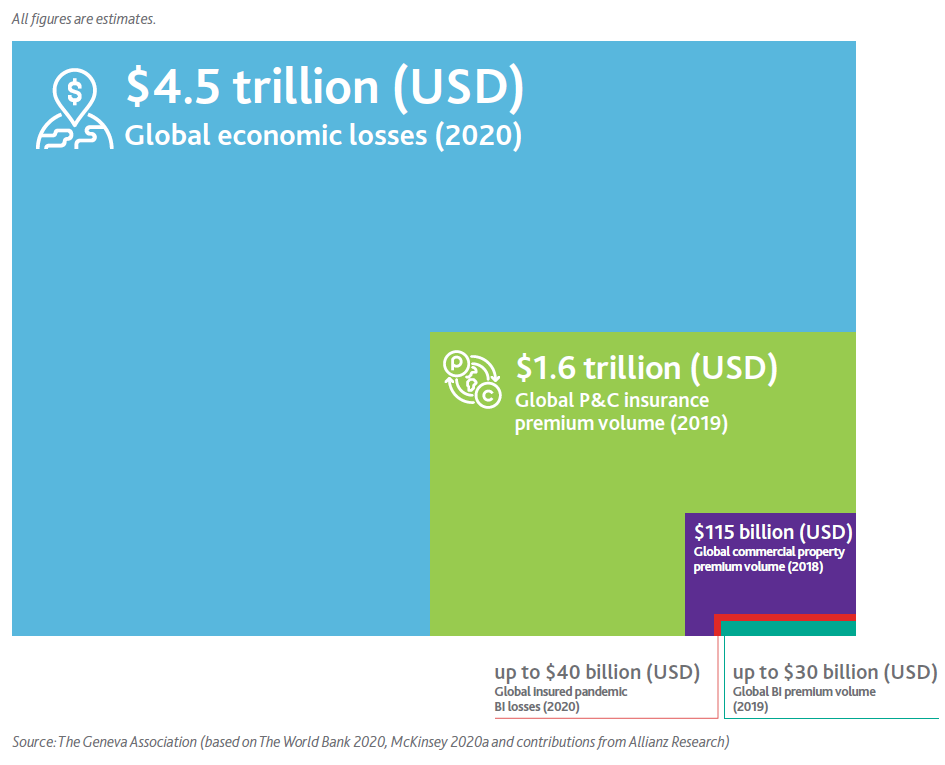

Unlike Tetris, thankfully, it is possible to manage. However, what it highlighted are the enormous challenges that are involved in insuring it. In addition, it also opened up new paths to future insurance solutions that could cover such global events of enormous proportions.