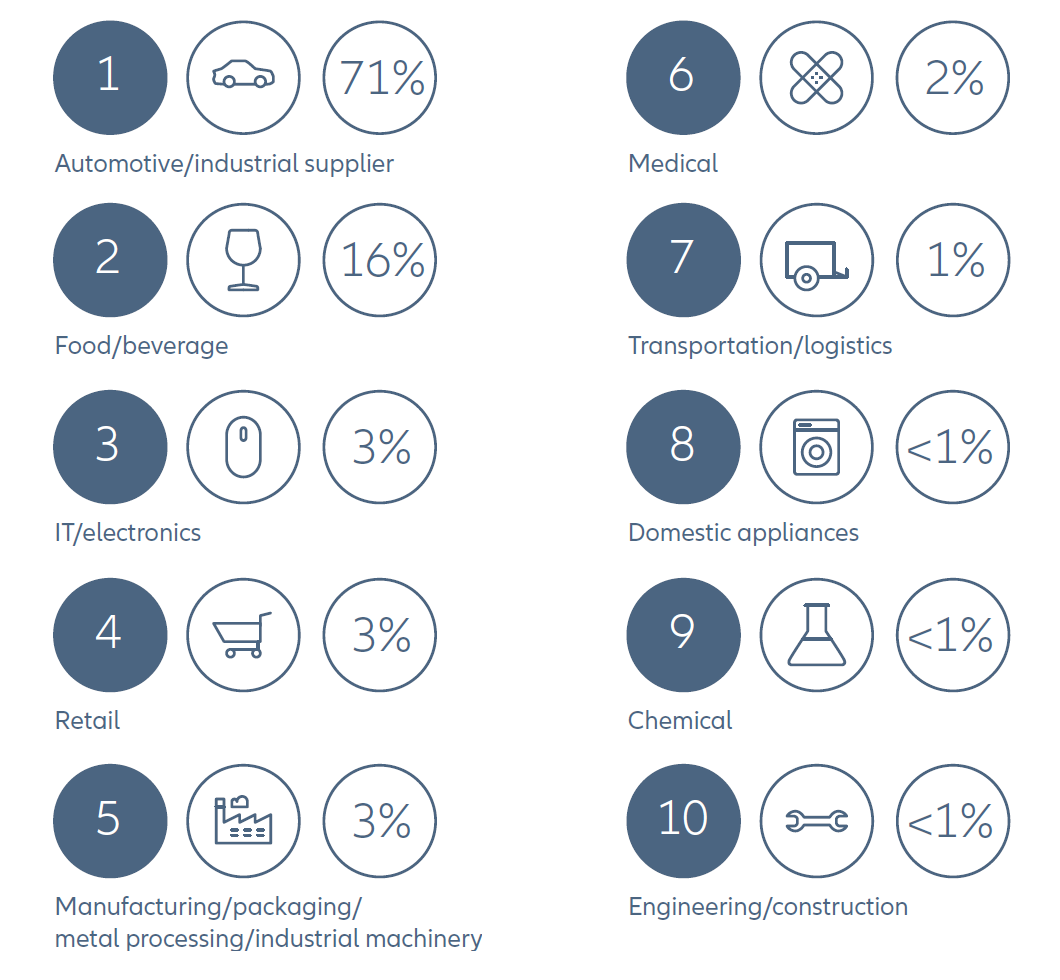

“We see an increasing number of recalls with higher units in the automotive industry,” says Carsten Krieglstein, Regional Head of Liability, Central & Eastern Europe, AGCS. “This is driven by factors such as more complex engineering, reduced product testing times, outsourcing of R&D and increasing cost pressures.”

Cars feature ever-increasing numbers of gadgets and services. Each new one increases the complexity of the vehicle and the chance that something may go wrong, resulting in another recall. In 2016, a record 53.2 million vehicles were recalled in the U.S. alone. In Europe, automotive recalls jumped 76 percent year-on-year. One of the largest recalls to hit the auto industry involves defective airbags. Up to 70 million units across at least 19 manufacturers are being recalled worldwide. Costs have been estimated at close to $24 billion. The report says this incident exemplifies the growing “ripple effect”, which impacts not only the automotive sector, but also other industries. Given the use of many common components, a single recall can impact a whole industry.

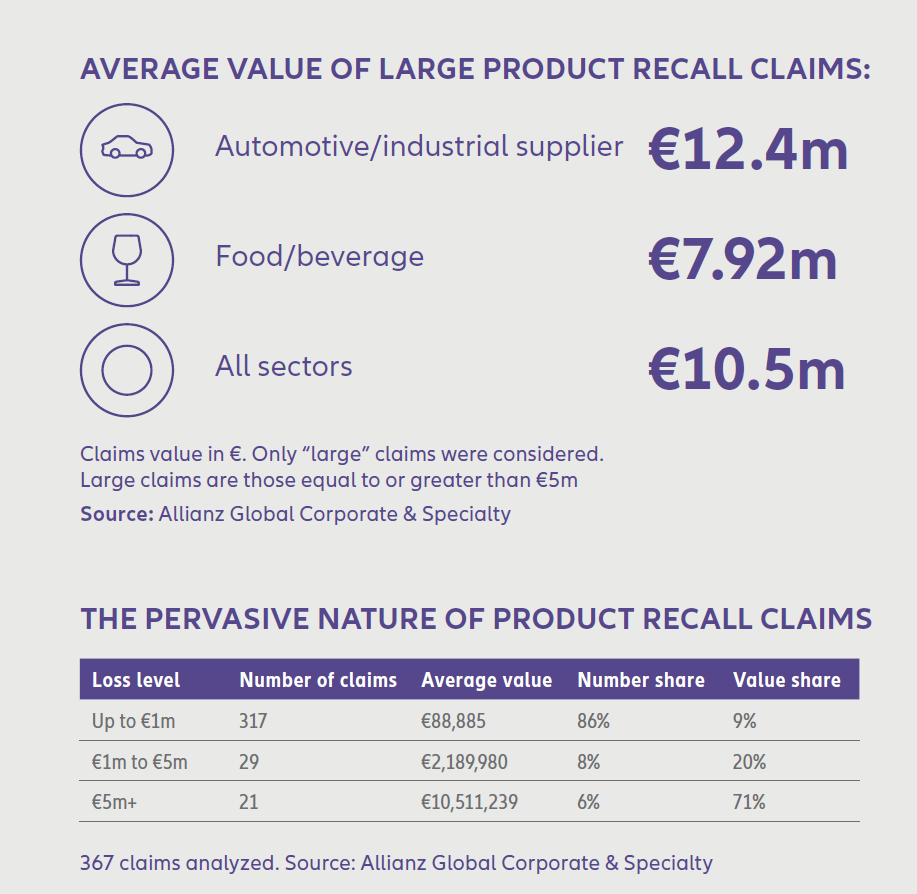

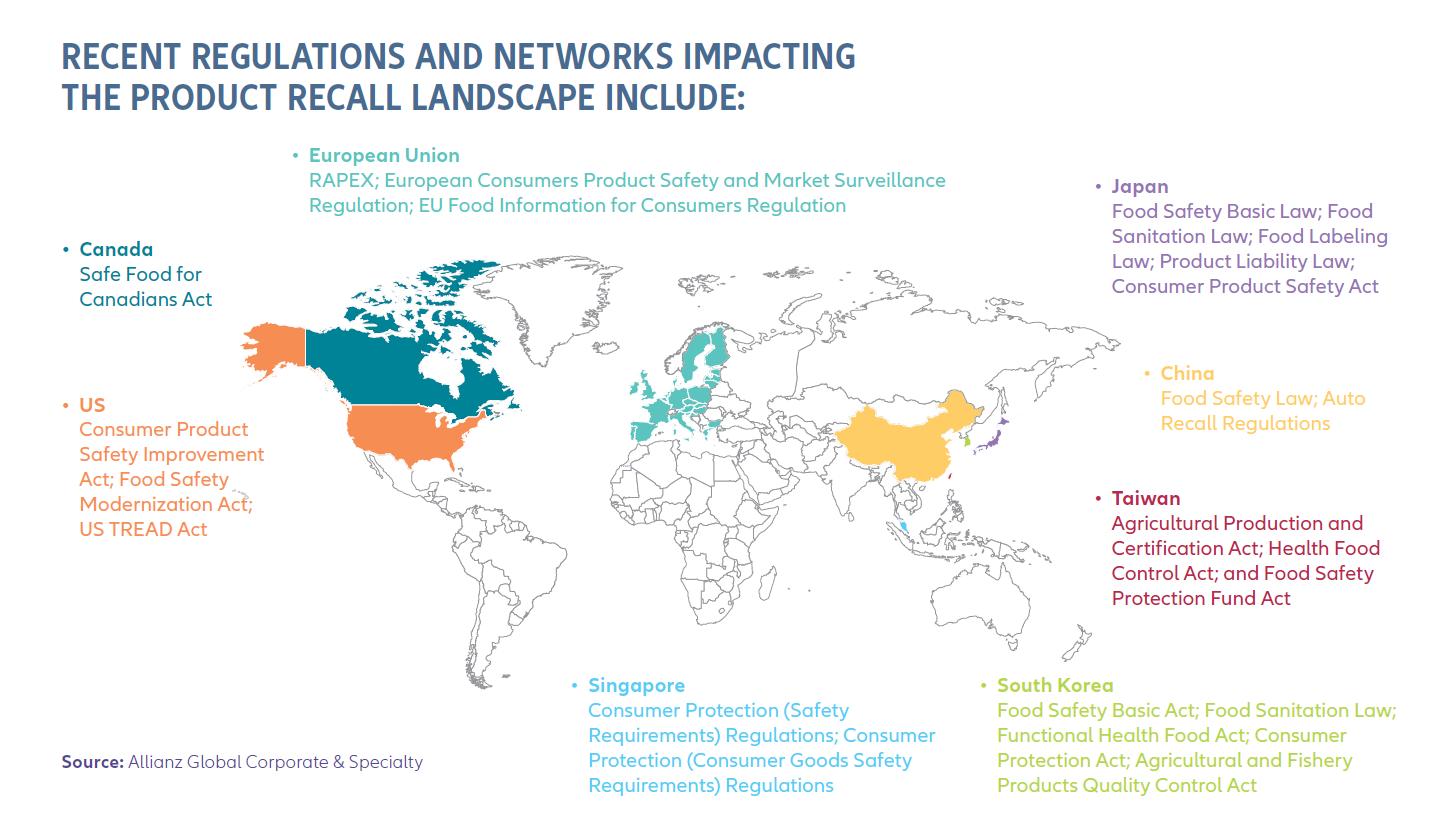

Food and beverage is the second most affected sector, accounting for 16 percent of analyzed losses with the average cost of a significant product recall claim almost $9.5 million (8 million euros). Undeclared allergens (including mislabeling incidents) and pathogens are a major issue, as is contamination from glass, plastic and metal parts. AGCS also notes that products from Asia continue to account for a disproportionate number of recalls in the U.S. and Europe, reflecting the eastwards shift in global supply chains and historically weaker quality controls in some countries. Yet, increasing safety regulation and consumer awareness are ensuring recall activity is also rising across Asia.