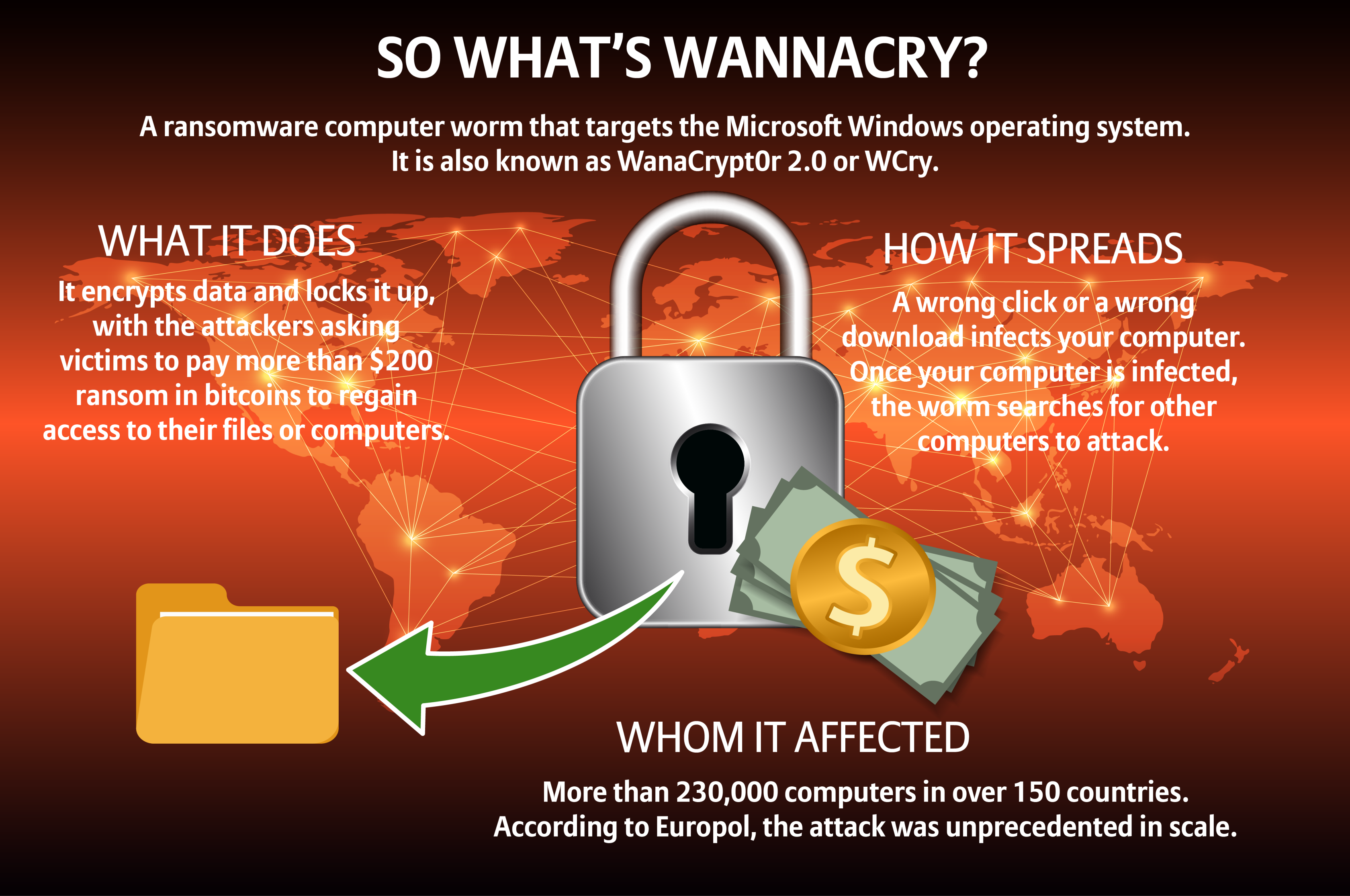

This week, WannaCry, a ransomware program, infected more than 230,000 computers in 150 countries. Hackers demanded payments in bitcoins to allow users to access their data.

The attack hit several large companies, including a major American parcel delivery company, a European car manufacturer and a Spanish telecom company. It disrupted the operations of Britain’s National Health Service and affected some operations of German rail network Deutsche Bahn, among others.

The incident again highlighted how vulnerable companies are to cyber risks – be it a technical glitch, a human error or a cyber attack – and the business interruption that usually follows.

Reuters reported that the total cost of resuming operations could run into billions of dollars for companies, with European and Asian companies particularly vulnerable. As such attacks become more frequent, companies are becoming aware of the need to protect themselves – not just from such attacks but also from the losses that they could bring.

This is why cyber insurance promises to be the next blockbuster in the insurance space, says Hartmut Mai, Chief Underwriting Officer for corporate lines at Allianz Global Corporate & Specialty (AGCS).

While cyber insurance is already a mature market in the United States with an estimated premiums volume of $3 billion, it is still an emerging segment in Europe and Asia.