Everything is interconnected. Smart homes turn up the heat when needed; smart cars tell you how to get home fastest and smart supply chain management allows maintenance to happen in between production steps. It’s the age of the “Internet of Things” where a network of physical devices like cars, houses or entire factories are embedded with electronics, software and sensors that allow all those objects to communicate and exchange data for the best resource efficiency and production results.

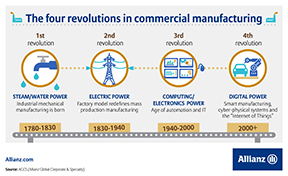

The “Internet of Things” is a part of the “Industry 4.0” concept – the fourth industrial revolution that describes the trend of automation and data exchange in manufacturing. These developments call for rethinking traditional ways of assessing and mitigating risks. Insurers, especially, must look beyond traditional risk monitoring and expand their understanding of products towards including service aspects like consulting already before a disastrous event happened.

Michael Bruch, Head of Emerging Trends at Allianz Global Corporate & Specialty (AGCS), is convinced that an insurance company can and must keep pace with this. For underwriting risks, it is no longer sufficient to look at historical data. Insurers must customize their pricing based on predictive risk models. This could be possible by the use of data analytics, says Volker Münch, Head of Global Property Insurance for High-Tech, Telecom and Services industries at AGCS.

The “Internet of Things” and the world of insurance

Are Industry 4.0 and the “Internet of Things” relevant for modern-day companies, especially in the manufacturing sector?

Volker Münch: Industry 4.0 is not an emerging concept. Many production facilities and processes are completely interwoven. For example, car manufacturers will adapt their production volumes based on sales trends. If they see that white cars with automatic gearboxes sell better than red cars with stick shifts, they start to produce those without having received any further orders. The logistics sector does the same: to save time, they share transport routes of their fleet with a maintenance center. Whenever one of their vehicles needs maintenance, the connected maintenance center will ensure the repairs are done en route instead of having to take the truck out of service. Companies that refuse to work this way will definitely lose when it comes to time and cost.

How far advanced is Allianz in this regard?

Volker Münch: I think we are already pretty advanced in our industry. Allianz Germany, for example, offers a product where the clients can take a picture of their damaged car after an accident, send it to us via an app and get the claim paid in only a few hours. Based on the collected accident data, patterns can be extracted. We can predict the likelihood of accidents in a certain area or at a certain time. It is almost a real-time data collection that allows you to adapt your products almost immediately.

Huge supply chains are a different challenge. A car manufacturer might have up to 30,000 first tier suppliers with an infinite number of locations. Data analytics helps us to discover interdependencies of suppliers as we map out supply chain networks to help prevent cumulative risks.

In AGCS’s latest Global Risk Dialogue the finance and insurance industry ranked among the 'potential losers' of Industry 4.0. But the examples seem to prove the opposite.

Michael Bruch: The definition of winners and losers actually goes back to a KPMG study. They were trying to map how advanced various industries are in embracing the implications of Industry 4.0 like the Internet of Things approach and display the potential to grow in new segments while not losing ground in their traditional areas. Unsurprisingly the automotive industry came out as the most advanced as manufacturers are becoming full mobility service providers, who also tap into communication or navigation sectors.

Financial services providers are experiencing growing competition when it comes to online services. However, we benefit from our expertise and new client demands in risk management. We are following the predictive maintenance approach: Allianz is already changing from a traditional insurer to a partner offering different services across the entire value chain. Instead of just paying our clients’ claims, we invest in loss prevention or consulting services.

In renewable energies for example, our gas or wind turbine manufacturing clients, already rely on our expertise to intervene during production of the device before a machinery breakdown happens.

How did the “Internet of Things” and Industry 4.0 change the way AGCS assesses risks?

Michael Bruch: We currently see a shift from tangible to intangible risks. Therefore, our customers now also require coverage for rather risks that are difficult to measure, such as reputational risks. Our solutions are becoming much more comprehensive, meaning we offer traditional insurance combined with consulting and other services, or alternative risk transfer solutions. We call it ’customized offers based on predictive analytics’.

Volker Münch: We are convinced that Allianz has tremendous potential in new areas beyond classical insurance. If we keep the pace with the “Internet of Things” and use predictive analysis efficiently. Of course, there will always be a market for traditional insurance products but there will be a demand for new risk mitigation solutions . We are well prepared to adapt to the changes the 4th industrial revolution is bringing.

Industry 4.0 – “winners” and “losers”

Download infographicRepublication royalty free if source is named: allianz.com.

More information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer: