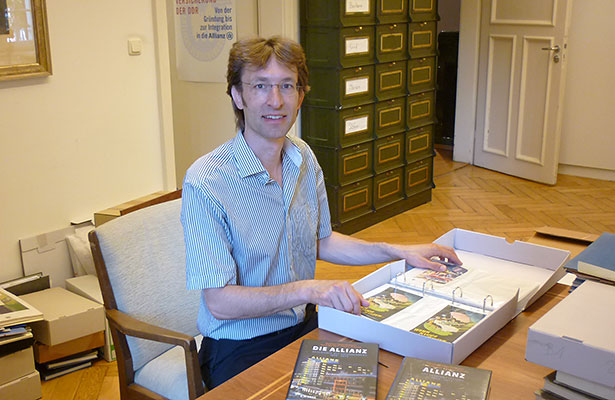

Allianz.com: Microinsurance normally refers to small insurance policies for low-income people in developing countries. You found that as far back as 1926, Allianz launched microinsurance in Germany. How did that come about?

Stefan Pretzlik : Before the 1920s, Life insurance in Germany was for the well-to-do only. That changed with the advent of democratization and with an accelerating rationalization process after World War I. We then saw broader political, social and economic participation of lower income groups. Allianz wanted to tap into this newly emerging consumer group. State-of-the art technology such as punch-card readers allowed Allianz to do so in a cost-efficient way. In 1926, Allianz launched a new business line which it literally called “Small Life Insurance”. The term “Microinsurance” was still unknown at the time. But the tagline was essentially the same: ’Protect yourself for only a few cents a day‘. Customers were encouraged to deposit their spare cents in a piggy bank - provided by Allianz - every day. This enabled clients to save up for their premiums due at the end of the month. At first, only funeral insurance was on offer, insured with a few hundred euros.

Has the model been successful?

Yes. Seen over the mid- and long-term, the model was extremely successful. At least as far as Life insurance is concerned. When similar efforts on the Property and Casualty (P&C) side were initiated after World War II, they faltered and were later abandoned. Even on the Life side, the German microinsurance model had to go through some teething troubles. Several times over, Allianz management was on the verge of shelfing the initiative. A first breakthrough came when the Small Life Insurance team moved away from negatively perceived funeral insurance offerings. Instead, their marketing and products started to focus on a brighter future, such as education insurance and – specifically for girls – dowry insurance.

The real boom of Small Life Insurance started when the German economic miracle kicked in by the early 1950s. Workers and employees were enjoying steeply rising incomes and wanted to protect their newly built wealth, even if still modest in comparison to today. By 1960, there were over 1.5 million Small Life Insurance customers.

Shortly thereafter, Small Life Insurance started its slow demise. The innovative business line had basically completed its job of winning many new customers for Allianz. Now these customers were moving on to more sophisticated products with higher sums insured, a reflection of their increasingly affluent standards of living. In 1967, the Small Life Insurance products were closed for new business.