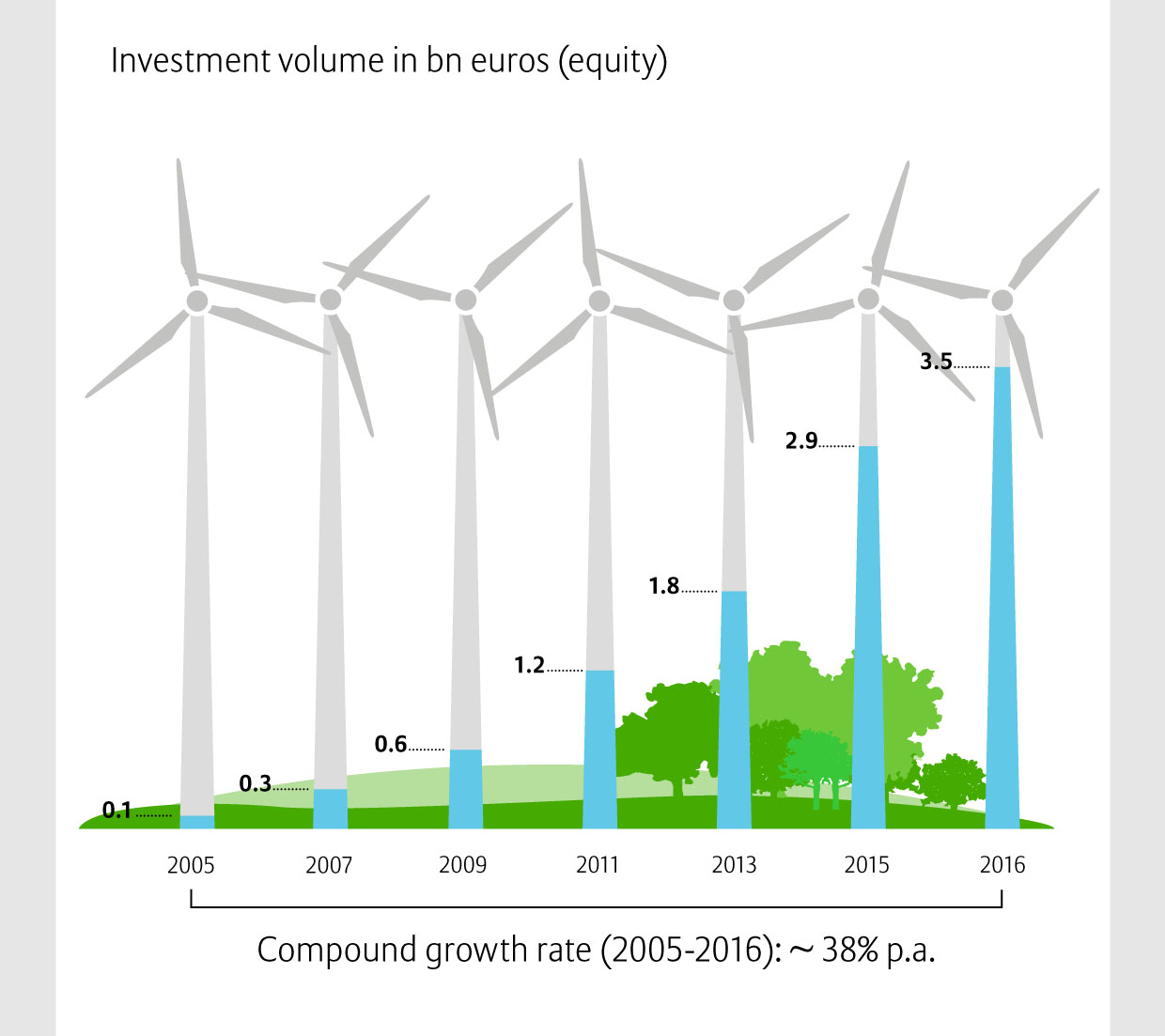

With the fourth tax equity investment in the United States, Allianz investments in the renewable energy sector exceed 3.5 billion euros, with a total of 74 wind farms and 7 solar parks located in Austria, Finland, France, Germany, Italy, Sweden and the United States. The wind and solar parks of Allianz generate enough renewable energy to supply over a million households, which is comparable to a city the size of central Paris.

About Allianz and Allianz Capital Partners

Allianz represents one of the world’s strongest financial communities, offering a broad range of insurance and asset management services. In 2015, Allianz employed around 142,000 staff in some 70 countries and achieved total revenues of 125.2 billion euros and an operating profit of 10.7 billion euros. Allianz Group managed an investment portfolio of around 640 billion euros. Additionally our asset managers Allianz GI and PIMCO managed 1.3 trillion euros of third party money. Allianz is active in a wide variety of sectors including real estate, infrastructure, renewable energy and equity and debt. Allianz’s long-term value strategies maximize risk-adjusted returns.

Allianz Capital Partners is the Allianz Group's in-house investment manager for alternative investments. With offices in Munich, London, New York and Singapore Allianz Capital Partners manages more than EUR 16 billion of alternative assets. The investment focus is on infrastructure, renewables as well as private equity funds. ACP’s investment strategy is targeted to generate attractive, long-term and stable returns while diversifying the overall investment portfolio for the Allianz Group insurance companies.

In addition to invest in renewable energy, the Allianz group has three other initiatives contributing to the growth of renewable energy in the US. Allianz Global Investors, one of the world’s leading active investment managers, has completed infrastructure debt investments of $9.4 billion between the US and Europe since 2013 with their first ever U.S. renewable energy debt investment of over $400 million in Grande Prairie Wind in 2016. Allianz Risk Transfer provides an innovative risk management solution for hedging wind volume risks for wind farms and has successfully executed Proxy Revenue Swaps with several counterparties in the US, among them Bloom Wind Farm and Microsoft, totaling more than 500 MW. Allianz Global Corporate & Specialty SE (AGCS), the global corporate and specialty insurer of Allianz SE, is one of the leading insurers of wind farms and solar energy projects globally.

www.allianzcapitalpartners.com

About EDF Renewable Energy

EDF Renewable Energy is a leading US independent power producer with 30 years of expertise in the renewable industry, covering all range of services from project origination, development, sales and marketing, to long-term asset management. EDF Renewable Energy specializes in wind and solar photovoltaic with presence in other segments of the renewable energy market: storage, biogas, biomass, hydro, and marine energy. EDF Renewable Energy’s North American portfolio consists of 8 gigawatts of developed projects with 4.1 gigawatts of installed capacity throughout the US, Canada, and Mexico. The operations and maintenance subsidiary, EDF Renewable Services, operates 10 GW throughout North America. EDF Renewable Energy is a subsidiary of EDF Energies Nouvelles. EDF Energies Nouvelles is the renewable energy arm of the EDF group, the leading electricity company in the world. For more information visit: www.edf-re.com

About MUFG (Mitsubishi UFJ Financial Group, Inc)

MUFG (Mitsubishi UFJ Financial Group, Inc.) is one of the world's leading financial groups, with total assets of approximately $2.9 trillion as of September 30, 2016. Headquartered in Tokyo and with approximately 350 years of history, MUFG is a global network with more than 2,200 offices in nearly 50 countries. The Group has more than 140,000 employees and about 300 entities, offering services including commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing.

The Group's operating companies include Bank of Tokyo-Mitsubishi UFJ, Mitsubishi UFJ Trust and Banking Corporation (Japan's leading trust bank), and Mitsubishi UFJ Securities Holdings Co., Ltd., one of Japan's largest securities firms. Through close partnerships among our operating companies, the Group aims to "be the world's most trusted financial group," flexibly responding to all of the financial needs of our customers, serving society, and fostering shared and sustainable growth for a better world. MUFG's shares trade on the Tokyo, Nagoya, and New York (MTU) stock exchanges. Visit www.mufg.jp/english/index.html.