- A stronger US dollar will not be enough to rein in inflation in the US. Even as the appreciation of the USD will reduce inflation by -1.4pp in the next three months, and the US is less exposed to surging energy prices, we still expect inflation to remain well above 2% next year. In this context, the Biden Administration is considering lifting some of the tariffs imposed on China during the Trump era, and stepping up efforts to strengthen supply chains.

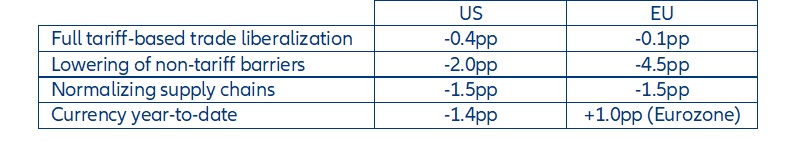

- However, we find that even a full tariff-based trade liberalization in the US and the EU would not be a game-changer for the inflation outlook. If tariff rates on the main import partners (including China) were shaved to zero, inflation would be reduced by just -0.4pp in the US and -0.1pp in the EU, given the high share of duty-free imports (72% in the US on non-agricultural goods, 56% in the EU) already in place.

- In contrast, lowering non-tariff barriers to trade would have a material impact. In the US, close to 80% of trade is affected by non-tariff measures, while in the EU it is close to 95%. We find that reducing non-tariff measures to trade to below 50% would lower corporate markups and in turn knock at least -2pp off inflation in the US and -4.5pp in the EU. Lowering protection for local producers could thus yield sizeable benefits for consumers, especially in the EU, where the -9% depreciation of the EUR will push up inflation by more than +1.0pp after one year.

- Easing supply-chain disruptions could also lower inflation by up to -1.5pp in both the US and the EU, according to our estimates. This would require normalizing industrial output and trade flows among key import partners in a context where China is likely to maintain its zero-Covid policy through Q2 2023. Separately, domestic policies could help, such as an infrastructure plan focused on ports and/or increasing competition in the shipping industry, accompanied by appropriate labor market policies.

Trade

How to ease inflation? Non-tariff barriers to trade in the spotlight

They could knock -4.5pp off inflation in the EU and -2.0pp in the US

Impact of trade-related policy measures on inflation

Source: Allianz Research

Trade liberalization is back on the agenda.

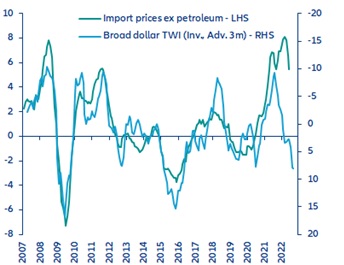

Even as the appreciation of the USD will reduce inflation by -1.4pp in the next three months via reduced import prices (see Figure 1), and the US is less exposed to surging energy prices, we still expect inflation to remain above its pre-pandemic level through at least the first half of 2023. This persistently high inflation has heightened policymakers’ concerns about its increasingly visible costs on the economy and growing public discontent. In this context, the US Administration is considering lifting some of the Trump-era tariffs imposed on Chinese goods. This follows a mandatory four-year review of the tariffs, which could result in their expiry in July and August. Rolling back some of the tariffs imposed on Chinese imported goods is seen as a way to ease the cost of living crisis on households by softening consumer prices of goods.

US import prices and broad dollar index

Sources: US BLS, BIS, Allianz Research

Contact

Ana Boata

Allianz Trade

Allianz Trade

Francoise Huang

Allianz Trade

Allianz Trade

Maxime Darmet

Allianz Trade

Allianz Trade

.jpeg)