- The ECB is facing a “risk trilemma” as its hawkish monetary policy pivot raises the specter of fragmentation risk, which threatens to impede the efficient transmission of monetary policy. At its next meeting on 21 July, the ECB will have to deliver on an anti-fragmentation tool that convinces the markets, keeps some constructive ambiguity, respects legal boundaries, and does not hinder the pace of policy normalization.

- However, the tool can only serve as temporary measure since it fights the symptom rather than the cause. While the ECB can compress default risk premia driving potential fragmentation (and can provide incentives for fiscal prudence through conditionality), it cannot directly address redenomination risk. Thus, the normalization of monetary policy puts more pressure on an effective rules-based fiscal governance in the Eurozone.

Capital Markets

Breaking spread: fragmentation risk in the Eurozone

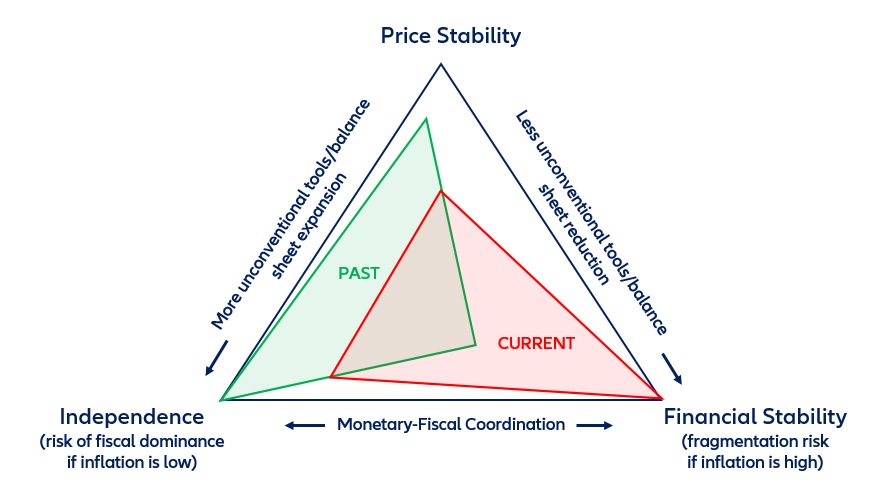

ECB risk trilemma shifting from deflationary to inflationary environment

Source: Allianz Research