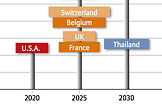

The baby boomers or the so called "power generation" are facing one of the most pronounced retirement income challenges in history. Due to dwindling state pensions, rising longevity and increasing personal responsibility for sufficient retirement savings baby boomers all over the world face similar problems. However, the peaks of the baby boomer cohort will be at different points in time across the countries. The United States is the first nation to arrive at its baby boomer peak in 2020 and therefore today acts as a trailblazer.

Retirement "tsunamis" all over the world

Downloads

Central, Southern and Eastern European countries will follow a few years later. Most astonishingly, the new Allianz Demographic Pulse shows that the time lag between the peak in the US and the peak in China will amount to approximately be 30 years. "The current US developments serve to foreshadow the challenges that other nations might face in the coming years. Our latest Allianz Demographic Pulse provides insightful analysis into this ticking demographic time bomb", says Jay Ralph, Board Member of Allianz SE and responsible for the NAFTA markets.

US first to experience tsunami effect

US baby boomers are the first to enter retirement. This situation will reach its peak in the year 2020. Most of the European "baby boomer tsunamis", for example in Germany, in France or in Great Britain will be are likely to follow the US boomer peak within approximately five years, reaching their respective peak in 2025. Other countries like Hungary, Spain, Turkey or China will face the same challenge but approximately 10 – 30 years later. Thus, these states can learn from other states and have more time to prepare for their difficult situations.

"The sheer magnitude of baby boomers entering into retirement will significantly increase the number of people dependent upon contributions from the working population. Overstrained public finances and increasing longevity will be a stark reality for retirees, businesses and governments", says Jay Ralph. Most of the US citizens – exactly 92 percent – agree and consequently see a retirement crisis looming, the latest Allianz US study Reclaiming the future shows. In this poll more than 3,200 US adults, aged 44 – 75 were surveyed by Allianz Life in Minneapolis to discover the unique needs, perceptions, and strategies that define the power generation’s need to rethink retirement.

After the financial crisis looms the retirement crisis

Another interesting key finding of the survey was for example that a surprising 61 percent of the respondents said they were more scared of outliving their assets than they were of dying. These fears serve as the underlying notion to the most important features of what Americans view as the ideal financial product. The ability to create a stable, predictable standard of living throughout retirement ranks first. This also becomes apparent as an overwhelming 80 percent of the people surveyed preferred a life-long guaranteed product with 4 percent return over a product of 8 percent return that is vulnerable to market downturns.

Surely, global social security systems vary and states are prepared differently. In the U.S., the home of Defined Contribution (DC) schemes, less than 10 percent of companies still offer Defined Benefit (DB) plans, whereas in Europe only recently reforms reduced the traditional generosity of their public pillars and increased the importance of private old-age provision. "While the U.S. situation is not totally comparable to the European and Asian ones, we can definitely learn from it. People in all regions need to rethink their retirement planning and seek competent financial advice", concludes Ralph.

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer.

Link to the disclaimer